Guide to Statutory Compliance in India 2025 [+Checklist Included]

Does the compliance department actually discuss this? 👇

We don’t know about them, but we are sure about one thing from our discussions with startup founders, HR and Finance teams. Statutory compliance does give them a hard time.

With so many statutes and their applications, it is not even close to easy to accurately calculate leaves and payroll.

This is our attempt to simplify the statutory compliances for HRs, finance managers and founders. Let’s get started, then!

What is Statutory Compliance?

Statutory compliance is the legal framework that all companies must follow to run their human resource and payroll functions seamlessly.

A business rulebook defines everything from how organisations operate to how they treat their employees, paycheck to benefits, working conditions, and fair treatment.

The central and State governments regulate the statutory compliance laws. Regardless of size, all businesses must comply with national and state laws.

Why is Statutory Compliance Important?

Statutory compliance in HR ensures that both employer and employee operate according to the country’s legal framework.

For employees, compliance guarantees fair compensation, timely wages, and security benefits like PF, insurance, etc.

For employers, statutory compliance reduces the risk of legal disputes and protects the company from lawsuits related to labour laws.

Understanding Statutory Compliance

Statutory compliance might seem like an added complexity to the business, but it protects you from big crashes later.

As a startup grows and onboards more employees, the statutory compliances become more complicated. Ensuring zero errors from the very beginning helps you avoid legal troubles later.

The need for statutory compliance

India has complex business regulations, making it challenging to keep up with laws and align your business. There are so many legislations to follow, so getting lost is easy.

For example, the Provident Fund requires employers and employees to contribute to this savings scheme. According to the law, the employer should contribute 12% of the basic salary and dearness allowance, of which 8.33% goes to EPS and 3.76% to PF.

How overwhelming is that? But then again, you cannot risk not complying with it.

Jet Airways is a real-life example of what happens if a business fails to deposit PF contributions. Before shutting down, the brand was supposed to pay ₹ 200 crore worth of PF and gratuity dues.

Differences in statutory compliance for organisations

Statutory compliance is the same for organisations, whether partnership firms, LLPs, or Pvt. Ltd company.

However, the complexity of the compliance process varies depending on the organisation's size, industry, and location. For example, an MNC expanded in different countries must adhere to each country's statutory compliance separately.

Take Samsung, for example. Its head office is in Korea, and its regional headquarters are in North America, Europe, Southeast Asia, China, the Middle East, Africa, and many other countries.

Can you imagine the legwork here?

A smaller company, such as a Bengaluru-based startup, will have much simpler requirements than Samsung.

Advantages of Statutory Compliance

Let’s understand the advantages of adhering to statutory compliance for employees and employers.

For employees:

Ensuring fair treatment of employees and protection against unfair practices

Ensure that employees are fairly paid, including adherence to minimum wage rates

Ensure safe working conditions and prevent employees from working excessively long hours or under inhuman conditions

For employers:

Avoid penalties due to non-compliance

Get protection from unreasonable wage demands or benefits by trade unions, ensuring negotiations are fair and within legal boundaries

Reduce risks of legal disputes and save the organisation from time-consuming and costly legal battles

What are the Risks of Non-Compliance?

The penalties for non-compliance depend on its intensity. However, typically, non-compliance leads to the following consequences:

Fines and penalties: Non-compliance with statutory regulations result in substantial fines and penalties from the government authorities. This also leads to financial losses because of expenses incurred through legal fees, settlement costs, compensation claims, etc.

Non-compliance gives a big blow to the company's finances and reputation.

For example, JP Morgan will pay $18 million for violating whistleblower protection law. The provisions in their contracts prevented clients from contacting the SEC with evidence of violations.

Legal disputes and litigations: You can encounter legal disputes and litigations from employees, trade unions, or regulatory bodies. Legal battles are time-consuming and expensive and drain company resources from business activities.

Himachal Pradesh High Court ordered a company to pay Rs15 Lakh compensation to the employee fired during her pregnancy after a long legal battle.

Employee dissatisfaction and turnover: Non-compliance with labour laws and employee dissatisfaction with wages, benefits, and working conditions can lead to high turnover rates, affecting your company’s market position and growth prospects.

Operational disruptions: Legal issues, penalties, and employee turnover resulting from non-compliance can disrupt your company’s operations. This can decrease productivity and increase administrative burden.

Regulatory scrutiny: If you have a history of non-compliance, you may also face increased scrutiny from regulatory authorities, such as frequent inspections, monitoring, and audits.

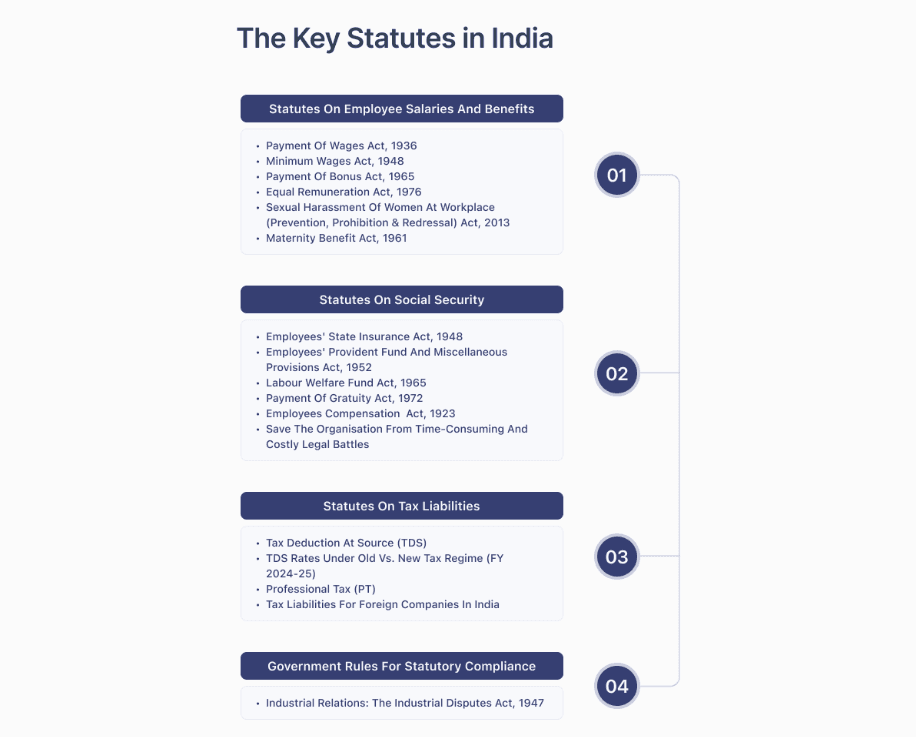

The Key Statutes in India

Here are the key payroll and HR statutes in India that organisations should comply with

Statutes on employee salaries and benefits

Payment of Wages Act, 1936

The Payment of Wages Act, 1936, ensures employees receive their wages on time and without any unauthorised deduction. It regulates the payment of wages for both direct and indirect employees.

According to the Act, the payment should be made before the 7th of every month if the number of employees is under 1000 or by the 10th if the number of employees is over 1000.

It also provides for periodically revising the minimum wages to account for inflation and changes in living costs

Minimum Wages Act, 1948

The Minimum Wages Act, 1948, mandates the minimum wage to be paid to skilled and unskilled labourers in various industries. The Central and Provincial governments establish it. This act ensures that workers receive sufficient wages to meet their basic needs and maintain a decent living standard. The factors considered for fixing the minimum wage include job type, cost of living, and wage period (hourly, weekly, or monthly).

Payment of Bonus Act, 1965

The Payment of Bonus Act, 1965, mandates employers to pay annual bonuses to employees in certain establishments, such as factories or organisations with more than 20 employees. According to the Act, the bonus should be calculated based on the employee's salary and the organisation's profits.

Employees with a monthly salary of ₹21,000 or less who have worked in the organisation for more than 30 days are eligible for the bonus. The bonus should be paid at the rate of a minimum of 8.33% and a maximum rate of 20% within 8 months from the close of the accounting year

Equal Remuneration Act, 1976

The Equal Remuneration Act, 1976 ensures that workers are paid equally for equal work regardless of gender. It prohibits discrimination in hiring, promotion, training, and transfer based on gender.

This Act promotes gender equality in the workplace and ensures that all employees, especially women, are treated fairly and receive equal respect and compensation for their work.

Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013

The goal of Sexual Harassment of Women at Workplace Act, 2013 is to provide women protection against sexual harassment at workplaces. It applies to all workplaces operating in India, including government, non-government, private sectors as well as sports and stadiums.

The act lists sexually unwelcome or uncomfortable behaviour like physical touch, demanding sexual favour, making sexually colored remarks and any other type of quid pro quo harassment. The goal of this act is to create safer workplaces for women with equal opportunities.

Maternity Benefit Act, 1961

The Maternity Benefit Act, 1961 provides paid maternity leaves to female employees. Applicable to all organisations with more than 10 employees, this act ensures women get leave to take care of the newborn and can return to work and resume their jobs after maternity leave.

It applies to employees working for more than 80 days in the organisation. The employee is paid only the basic salary during this period.

The latest amendments in the Act provide employees with the following benefits:

The employee can apply for up to 8 weeks of prenatal care leaves

The employee can apply for leave in case of adopting a child under 3 years of age

The paid leaves have been increased from 12 weeks to 26 weeks

Provision of work-from-home has also been introduced that can be used at the end of the 26-week tenure, depending on the nature of the work

Provision for creche facility allowing women to work worry-free

Statutes on Social Security

Employees' State Insurance Act, 1948

The Employees' State Insurance Act, 1948, provides health insurance benefits covering medical, maternity, disability, and dependent benefits in case of an employee’s death due to occupational hazards. According to the act, the employer must contribute 3.25%, and employees contribute 0.75% of the monthly paycheck towards this benefit. Employers in non-seasonal factories with more than ten employees must ensure this benefit. However, it is only for employees earning less than 21,000 per paycheck and ₹ 25,000 for persons with disabilities.

Employees' Provident Fund and Miscellaneous Provisions Act, 1952

The Employees' Provident Fund and Miscellaneous Provisions Act, 1952 aims to provide financial security and stability through retirement saving schemes. The Act mandates employers and employees to contribute a certain percentage towards the Provident Fund, which can be withdrawn upon retirement.

It applies to establishments with over 20 employees and is calculated based on the basic salary, which should be ₹15000 and dearness allowance.

Labour Welfare Fund Act, 1965

The Labour Welfare Fund Act, 1965 mandates establishing welfare funds for the benefits of labourers. The Act ensures that the labourers get good working conditions, social security benefits, and a better standard of living. It is enacted under the state government and is overseen by the state labour welfare board, which determines the amount and frequency of contributions made by employers.

Payment of Gratuity Act, 1972

The Payment of Gratuity Act, 1972, ensures the payment of gratuity to employees working in an organisation with over ten employees. Gratuity is an amount paid by an employer as a gesture of gratitude for the continuous service of employees for a minimum of five years or more.

Employees Compensation Act, 1923

The Employees Compensation (Amendment) Act, 1923 helps an employer be responsible for discharging their moral obligation towards employees when an employee suffers from a disease, any form of physical disability, or any other risky working conditions while working in a particular organisation.

Statutes on tax liabilities

Tax Deduction at Source (TDS)

TDS is one of the most important statutory regulations. It is deducted from the employee's salary as per The Income Tax Act. It is managed by the Central Board of Direct Taxes, which comes under the Indian Revenue Services. In TDS, the payer deducts the tax before paying the recipient and then remits it to the government.

Applicable to salaries, interest, professional fees, contractor charges, and commissions, TDS has different tax rates for salary slabs under the Income Tax Laws

TDS Rates under Old vs. New Tax Regime (FY 2024-25)

Professional Tax (PT)

Salaried employees earning a monthly income are required to pay a certain percentage of their earnings to their respective state governments as professional tax. An organisation deducts PT directly from an employee’s monthly salary and the breakdown is reflected on one’s payslip. Professional tax in a month cannot exceed ₹2500.

Tax Liabilities for Foreign Companies in India

Foreign companies in India are taxed at a flat rate of 35%. Besides this, if the company’s net income is between ₹1 cr and ₹10 cr, an additional 2% surcharge is also levied. If the net income is above ₹10 cr, the cess becomes 5% of the income tax amount with an additional health and education cess at 4% of income tax and surcharge (if any).

Employees Compensation Act, 1923

The Employees Compensation (Amendment) Act, 1923 helps an employer be responsible for discharging their moral obligation towards employees when an employee suffers from a disease, any form of physical disability, or any other risky working conditions while working in a particular organisation.

Government Rules for Statutory Compliance

Industrial Relations: The Industrial Disputes Act, 1947

The Industrial Disputes Act, 1947 aims to secure industrial harmony by providing machinery and procedures for investigating and settling disputes. The Act extends to worker unions and individual employees working within any industry in the country. However, it does not include people in administrative or managerial posts or the Defense forces under its purview.

Ensuring Statutory Compliance

Let's focus on how to comply with statutory regulations effectively to avoid risks of loss and penalties.

Documenting Policies & Procedures

Ensure that all policies and procedures are well documented and easily accessible for mutual benefit to employees and the company:

Create comprehensive digital manuals and mention all the compliances

Maintain records of updates

Ensure transparency and communicate policies to all employees

Staying Updated on Changing Acts and Policies

Compliances are updated frequently to keep up with the socio-political and economic changes. Thus, it is crucial to formulate policies, put them into action and update them as per the government norms. You can achieve this by:

Subscribing to newsletters and legal updates

Attending seminars and workshops on relevant legal changes

Using a tool that automatically updates if any law changes

Conducting Compliance Audits

Audits help you understand compliance trends and practices. It also helps in assessing how compliant the organisation is in treating employees and how compliant employees are. You can achieve this by:

Conducting regular audits

Engage with third-party auditors or take the help of tools for unbiased and correct assessment

Implement corrective measures in case of discrepancies

Training Employees

Training and workshops help mitigate communication challenges between the employees and the organisation regarding ensuring compliance. You can achieve this by:

Conducting/ attending training sessions

Provide access to e-learning modules on compliance

Update the training programs regularly

Statutory Compliance Checklist

Here is the complete list of statutory compliance-specific Acts that an organisation must follow. These are subject to the applicability conditions mentioned in the respective Acts,

Shops And Commercial Establishments Act

The Employees Provident Funds and Miscellaneous Provision Act, 1952

The Employees State Insurance Corporation Act, 1948

The Professional Tax Act, 1975

The Labour Welfare Fund Act, 1965

The Contract Labour (Regulation & Abolition) Act, 1970

The Child Labour (Prohibition & Regulation Act), 1986

The Minimum Wages Act, 1948

The Payment of Wages Act, 1936

The Payment of Bonus Act, 1965

The Maternity Benefit Act, 1961

The Payment of Gratuity Act, 1972

The Equal Remuneration Act, 1976

Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013

The Employees' Compensation Act, 1923

The Industrial Disputes Act, 1947

The Apprentice Act, 1961

The Interstate Migrant Workmen (Regulation of Employment and Conditions of Services) Act, 1979

The Factories Act, 1948

The Trade Unions Act, 1926

Conclusion

The best way to avoid the headache of statutory compliance is to delegate the entire responsibility of statutory compliance to an HRMS solution like Craze.

Craze is a people-operation software that processes compliant, accurate payroll for employees and contractors. This means no more nightmares over staying compliant.

Craze is an all-in-one platform for HR, Finance and IT teams to manage core HR activities and process compliant payrolls. Bonus is an empathetic support team that’s always ready to help.

Want to explore it further?

Explore More Guides on HR Compliance & Statutory Deductions

Stay informed about key HR responsibilities, ESI contributions, and statutory salary deductions. These guides will help you navigate regulations and ensure your payroll processes are aligned with current requirements: