Zoho Payroll, which comes from Zoho's house, is one of the payroll software options for Indian startups, scaleups, and SMEs. However, existing users of Zoho Payroll have mixed thoughts about the tool.

Some of the most common complaints about the tool are slow loading time, data migration challenges, and limited customisation for payroll reports.

Suppose you agree with these Zoho Payroll reviews and want to explore a few Zoho Payroll alternatives. In that case, there is no harm, especially because fast-growing startups and scaleups cannot afford workflow disruptions or feature gaps that might slow their momentum.

This blog will take you through the top Zoho Payroll alternatives, their key features, and use cases so you can select the best-fitted one.

Let’s get to business!

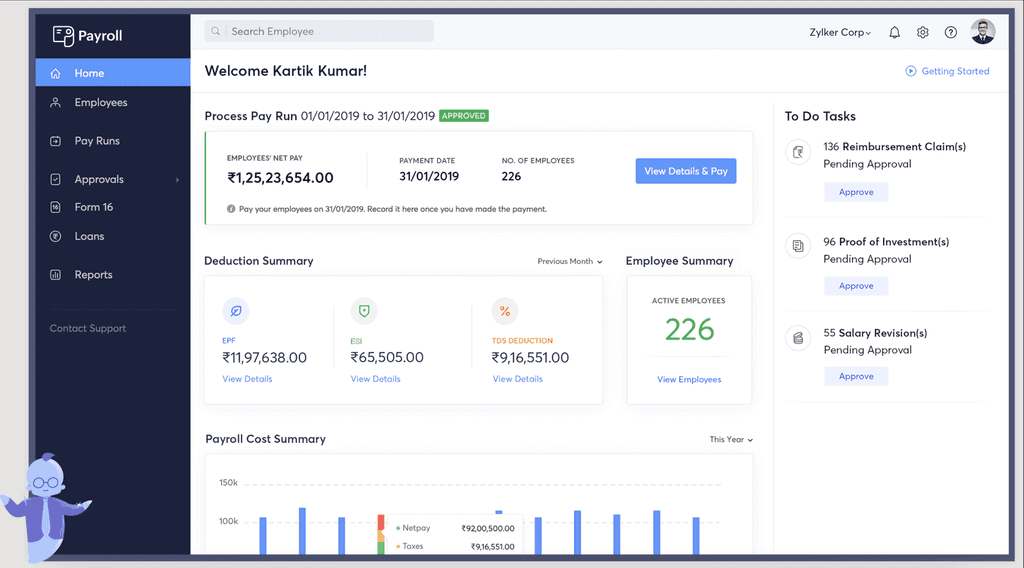

Zoho Payroll is an integrated payroll system that simplifies payroll processes. It ensures statutory compliance and, on average, saves 70% of customers' operations time.

Here are the core features of Zoho Payroll:

Employee onboarding: Automate your onboarding process with seamless data migration, pre-defined templates to import salaries, employee self-service, and more.

Compliant payroll processing: Pick payroll routine, apply custom deductions, disburse salaries in one click, and share payslips online.

Self-service portal: Employees can access pay and tax summaries, notifications, loan deductions, documents, tax forms, etc.

Payroll reporting: Generate compliant payroll reports considering tax deductions, and mandatory government contributions, and generate compliant payslips.

Before getting into the top Zoho Payroll competitors and Alternatives, take a look at what Zoho users struggle with, according to G2 reviews:

Slow customer response time

“Response time for the customer service is slow.

Dashboards and the templates page could have been better“ - source

“1. Multilayer process flow need to improve.

2. Customer supportslow response time.

3. There are some limitations with geographical coverages.” - source

Takes a long time to migrate data from other sources

“Migrating from other sources takes time. Sometimes it leads to slowness.” - source

Limited customisation in payroll reports

“customization to the payroll reports needs to add more features to match the differnt requests we get from employees to be added to their reports” - source

No feature to run payroll in batches

“The missing feature which according to me lacks is running payrolls in batches.” - source

Here’s a sneak peek into the top Zoho Payroll alternatives:

List of Zoho Payroll Alternatives:

Craze- Best for Indian startups and growing businesses looking for all-in-one HR, Payroll and IT software in one place

RazorPayX Payroll - Best for SMEs with basic payroll automation needs

Keka - Best for large enterprises with high budgets

Kredily- Best for SMBs with basic payroll and tax management needs

HROne - Best for Medium and large enterprises with basic payroll needs

PocketHRMS - Best for SMEs and large enterprises

Qandle - Best for Mid-market companies with basic payroll needs

ZingHR - Best for SMBs and large enterprises with a high number of contractors and freelancers

FactoHR - Best for SMBs with customisation needs

GreytHR - Best for SMBs with basic payroll automation needs

1. Craze: Startups and scaling businesses looking for an advanced, integrated payroll system

Craze tops our Zoho Payroll alternatives list because its payroll engine is built for India-specific compliance yet stays simple enough for a 10-person seed team and powerful enough for a 500-person scaleup. One click runs payroll across multiple entities, auto-calculates PF, ESIC, TDS, and PT, then syncs payslips to employee dashboards instantly. Attendance and leave data flow in automatically, so overtime, loss of pay, and bonus calculations are always accurate.

Beyond clean calculations, Craze gives founders transparent per-employee pricing and lightning-fast support on WhatsApp or Slack. Employees enjoy self-service for tax declarations, reimbursements, and Form 16 downloads, while finance teams export salary registers, contractor invoices, and compliance reports without extra plug-ins.

Learn more about Zoho Payroll vs. Craze.

Key features

One-click payroll with automatic PF, ESIC, TDS, PT, and Form 16 generation

Flexible salary structures, arrears handling, and backdated revisions

Self-service portal for payslips, tax proofs, reimbursements, and leave tracking

Auto-sync with attendance and leave modules for precise overtime and loss-of-pay calculations

Contractor and intern payments processed in the same run with GST or TDS rules applied

Built-in loan and advance management with EMI scheduling and deduction tracking

Payroll reports and salary registers are downloadable in Excel, PDF, or via API export

Role-based access so HR can prepare inputs while finance reviews and finalises

Bank-ready payment files and the option to disburse salaries right from the craze dashboard.

Sync payroll and expenses with your general ledger using Zoho Books integration

Pricing

Growth: Pricing starts at ₹60/month/employee for Core (with no feature gating). You can add other modules like payroll, leave & attendance, IT asset management, engagement, and performance with additional charges.

Custom: Appropriate for enterprises with 500+ employees.

Here’s what existing Craze customers say about the product 👇

2. RazorpayX Payroll – Software for SMEs with payroll automation

RazorPayX Payroll software automates payroll processes so you can auto-calculate salaries and pay employees on time. The tool handles payments and filings of PF, TDS, ESI, and PT, ensuring statutory compliance.

Key features

CTC calculator and offer letter generator to manage employees from onboarding to exit

Self-service dashboard for payslips, Form 16, and investment declarations

Auto-sync payroll with time and attendance for accurate salary calculation

Pricing

Prime: ₹2999/month for up to 20 employees

Elite: ₹5999/month for up to 50 employees and ₹120/employee/month for extra employees

Enterprise: Custom pricing plan

The Prime plan has basic payroll features, and the Elite plan has limited expense management features.

Read this blog if you are looking for Razorpay Payroll alternatives.

3. Keka – Good software for medium to large enterprises with high budgets and advanced payroll requirements

Keka HR and payroll software simplifies Indian payroll processes ensuring statutory compliance. It enables you to configure salaries and revise them without any prior payroll knowledge.

Key features

Run payroll preview before salary disbursement

Share payslips via emails or SMS or bulk print them if required

Automate tracking of new and existing employees to review and settle payments

Pricing

Foundation: ₹9,999/month for up to 100 employees and ₹90/month for each extra employee

Strength: ₹12,999/month for up to 100 employees and ₹120/month for each extra employee

Growth: ₹15,999/month for up to 100 employees and ₹150/month for each extra employee

The Foundation plan does not include people analytics, reports, or e-signature, and the Strength plan does not have workflow automation or a custom report builder.

Here's Keka review in detail.

4. Kredily – Budget-friendly payroll solution for businesses with basic payroll and tax management needs

Kredily is a top Zoho Payroll competitor that allows you to configure payroll specifics before payouts. It streamlines payroll and ensures timely salaries via bank account transfers.

Key features

Automated tax management with a consolidated view of investment declarations with supporting evidence

Build personalised salary structures including base, recurring, and variable

An online payslip generator to create detailed employee payslips

Pricing

Free forever: ₹0 /Month

Professional: ₹1499/Month for up to 25 employees and ₹60/extra employee

Enterprise: Custom pricing

The free plan offers basic payroll features. The professional plan does not include payslip bulk download, income tax computation, etc.

5. HROne – Good software for complete payroll management

HROne is one of the best Zoho Payroll competitors. It lets you maintain compliant payroll processes and create many salary structures to process timely payouts to diverse employee groups.

Key features

Automated CTC calculator for accurate salary disbursement

Auto-generate an error list to fix post-payroll issues

Automated challan generation and PF, ESI deduction

Pricing

Basic: ₹ 4950 /Month for 50 users and ₹99/month for each extra employee

Professional: ₹ 6500 /Month for 50 users and ₹130/month for each extra employee

Enterprise: Custom pricing for 50+ Teams

The Basic and Professional plans do not support recruitment, expense management, etc.

6. PocketHRMS - Good for businesses with basic payroll needs and no integration requirements

PocketHRMS is an AI-based cloud HRMS platform that automates compliance handling. The tool fulfils advanced payroll needs and ensures error-free payouts.

Key features

Multi-category and single-employee payroll processing

Generate regulatory forms like Form 16, ECR, etc., for IT returns

Create many employee categories for setting different payroll rules

Pricing

Standard: ₹ 60/Employee/Month

Professional: ₹ 90/Employee/Month

Premium: Custom pricing

The standard plan does not have payroll integrations or customisable dashboards. The standard and professional plans do not include exit, FnF management, or a help desk.

7. Qandle – Good software for medium businesses with basic payroll needs

Qandle streamlines payroll processes, making managing salaries and approval workflows more efficient. It allows you to integrate payroll with other apps to create a centralised system.

Key features

Real-time payroll reports to view pay rates, bank transfers, payroll history, etc.

Auto-calculate salaries, including bonuses and incentives

Self-service portal to view and edit pay stubs, view earnings, etc.

Pricing

Foundation: ₹2950/month for up to 50 employees and ₹59/month per extra employee

Regular: ₹4950/month for up to 50 employees and ₹99/month per extra employee

Plus: ₹6200/month for up to 50 employees and ₹124/month per extra employee

Premium: ₹8000/month for up to 50 employees and ₹160/month per extra employee

Enterprise: Custom pricing

The Foundation and Regular Plans do not include a dedicated account manager. Plus, they don't support strategic HR features, such as onboarding, exit management, etc.

8. ZingHR – Good software for businesses with a larger freelancer and contractor workforce

ZingHR’s Zero Touch payroll eliminates manual payroll processes. It facilitates daily, weekly, monthly, and outcome-based payments with transparency and compliance. The tool automates tax filing and provides access to real-time payroll data.

Key features

In-built analytics and trends (hours worked, pay rates, taxes, etc.)

CXO dashboard for payroll insights

Payroll audit trails

Pricing

Undisclosed

9. FactoHR – Good for mid-sized businesses with customisation needs

FactoHR is a wizard-driven, integrated payroll software that simplifies payroll tasks. It offers process customisations to accommodate current and future business needs.

Key features

Categorise employees in multiple payroll groups based on payroll type, calendar, etc.

Employee self-service portal and mobile app

Customise payslip with 15 in-built formats

Pricing

Core: ₹4,999 /Month for 50 users and ₹69/month for each extra employee

Premium: ₹5,999 /Month for 50 users and ₹89/month for each extra employee

Ultimate: ₹6,999 /Month for 50 users and ₹119/month for each extra employee

FactoHR has three plans: Core, Premium, and Ultimate. The Core plan does not support mobile app, policy configuration, and multiple currencies.

10. GreytHR – Good payroll software for businesses with basic payroll automation needs

GreytHR’s payroll software allows you to streamline and control your payroll system. It automates payroll processes, including inputs, payouts, statutory compliance, self-service, and settlements.

Key features

Configurable payroll engine

Detailed TDS (IT) calculations and eTDS returns

Pricing

Starter: ₹0/month for 25 employees with limited features

Essential: ₹3495/month for 50 employees and ₹35/month/employee for extra employees

Growth: ₹5495/month for 50 employees and ₹65/month for each extra employee. Add-on pricing for business expense claims management

Enterprise: ₹7495/month for 50 employees and ₹105/month/employee for extra employees

The starter plan includes basic payroll features, and the growth plan does not support business expense claims management. It is available as an add-on.

Features vary as per business needs. However, we researched several user reviews to create a standard list of the must-have features in the best Zoho Payroll Alternatives. Here’s the list:

Automated tax management: Choose a tool that provides end-to-end tax management, including automatic calculations, filing, and compliant reporting based on local taxes

Employee self-service portal: Pick a tool that offers a self-service portal to view taxes, salaries, leaves, download payslips, and tax forms, and update personal information

Integration capabilities: Make sure the tool you choose integrates with your existing accounting, HR, and other systems

Salary configuration: Look for tools that let you customise salary structures so you can categorise employees into multiple pay groups and disburse salaries on time

Security features: Pick a tool that has advanced security measures like data encryption, access controls, etc. to protect sensitive information

Customisation: Choose a tool that allows payroll process and report customisation to accommodate your current and future business needs

Customer support: Your software vendor must have 24/7 support that instantly responds to your queries

Payroll batch processing: Choose a tool that allows you to run multiple payrolls simultaneously so you can process payments for employees assigned to different pay cycles

All the Zoho Payroll alternatives in our list have their own features and use cases. However, you should select the software that best suits your needs.

We might sound biased, but our vote goes to Craze!

Craze is a smart pick if:

You are a startup or scale-up building people operations from the ground up, and need payroll that grows with headcount

You are frustrated with legacy tools that hide essential features behind pricey add-ons and surprise fees

You want a support team that responds in minutes, understands Indian compliance, and solves issues without long ticket back-and-forth

Want to know how Craze can help?

Do any of the listed alternatives allow multiple payroll runs in different cycles within the same month?

Yes. Craze lets you create pay groups and run them whenever you like. Keka and FactoHR also support on-demand or supplementary runs. Others, such as GreytHR and HROne, allow an “off-cycle” or bonus run, but you may need to request the feature from support. RazorpayX Payroll and Kredily stick to a single monthly cycle.

Can I integrate these payroll tools with my existing accounting or HR systems, such as Tally or Zoho Books?

Most of the contenders export journals that Tally or QuickBooks can import. Craze ships a direct connector for Zoho Books and offers Tally-ready files. Keka, GreytHR, and FactoHR provide Tally plugins, while RazorpayX Payroll and Qandle rely on generic CSV mappings or open APIs. Always confirm whether the integration is native, requires a middleware tool, or is simply a file download.

Which alternatives provide built-in compliance updates for changes in Indian labour and tax laws?

Craze pushes every statutory update, whether it is PF rates, ESIC limits, new PT slabs, or TDS thresholds are updated into the platform automatically. You get alerts, revised calculations, and updated reports without lifting a finger.

How difficult is it to migrate payroll data from Zoho Payroll to a new platform without payroll downtime?

HRMS like Craze offers a white-glove service: you fill a simple Excel sheet, the team imports it into the backend, and employees can start with history intact. Keka, GreytHR, and FactoHR provide migration utilities that map Zoho fields and let you schedule a cut-over. Tools like RazorpayX Payroll or Kredily expect you to prep CSV files yourself, so plan extra time for validation. In most cases, a clean migration takes three to five working days if you have your data organised.