Full and Final (FnF) Settlements and

Employee Exits

September 26 2024

Employee exits are a critical phase in the employment lifecycle, and managing them efficiently is essential for maintaining a positive work environment and legal compliance. A crucial part of this process is the Full and Final (FnF) Settlement, which involves clearing all dues owed to a departing employee.

The FnF process not only ensures that both the employee and employer part ways amicably, but it also helps avoid potential legal disputes and maintains the organization’s reputation. However, the process can be complex, involving various statutory compliances, timely payouts, and meticulous documentation.

Whether you are an HR professional, business owner, or a tax consultant, understanding the nuances of the FnF process is crucial for handling employee exits effectively. This blog helps you handle this without ambiguity

What is Full and Final Settlement (FnF)?

Significance of FnF in the Employee Exit Process

Legal Compliance: Ensures the employer adheres to labor laws and avoids legal disputes.

Employee Satisfaction: Provides a positive exit experience, maintaining goodwill and reducing the risk of negative feedback.

Clarity and Transparency: Prevents misunderstandings by clearly outlining all due payments and deductions.

Key Components Involved in the FnF Settlement Process

Salary Dues

Leave Encashment

Bonuses

Gratuity

Retiral Benefits

Deductions

Reimbursements

FnF Payslip and Settlement Letter

Form 16

We shall see how to calculate each of these components in this blog.

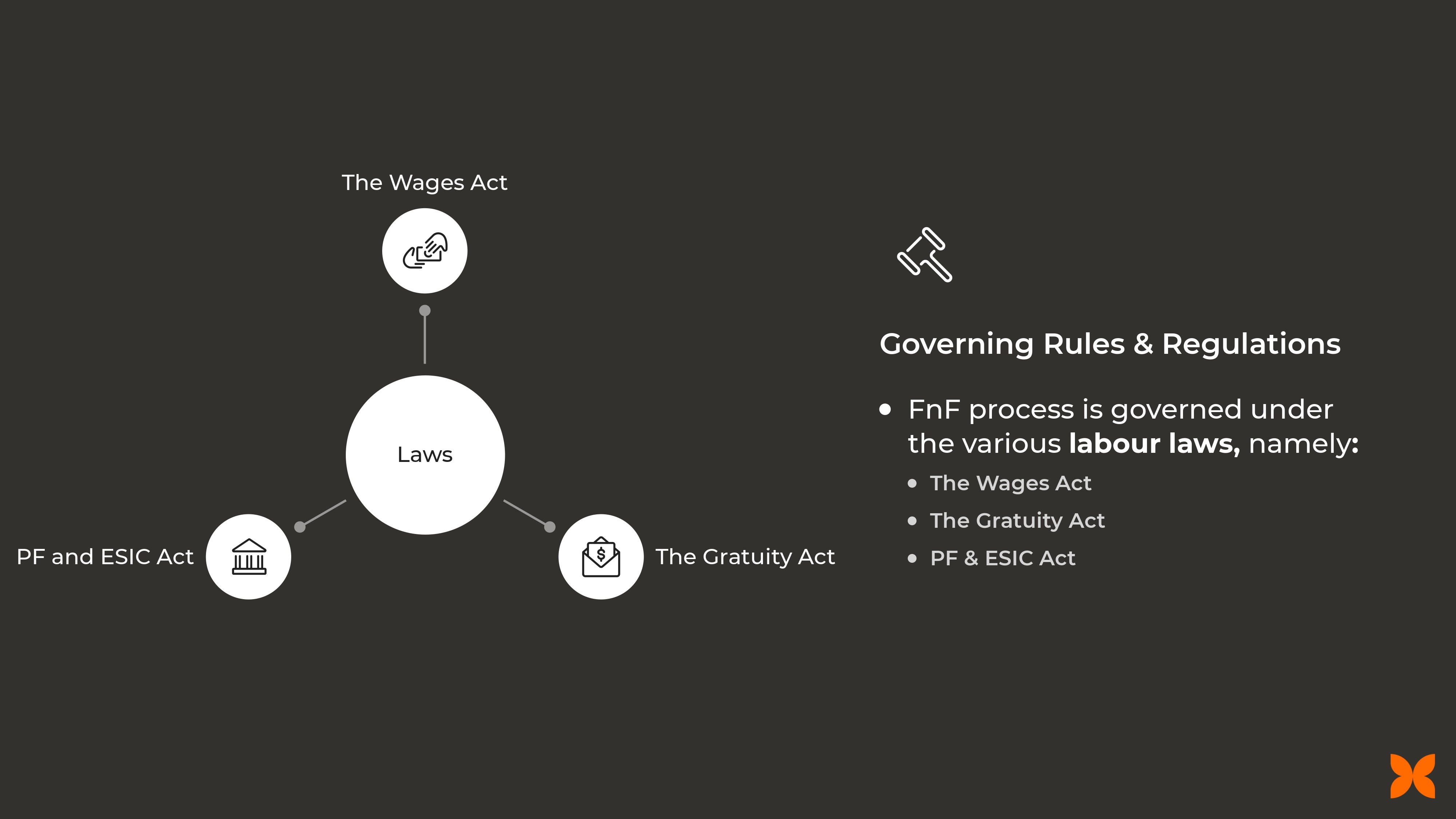

Governing Laws and Regulations

The Full and Final Settlement (FnF) process is governed by several labor laws and regulations that ensure the rights and obligations of both employees and employers are upheld.

Key Labor Laws Governing the FnF Process

The Wages Act

Purpose: Governs the timely payment of wages and provides a framework to prevent unauthorized deductions.

Impact on FnF:

Ensures that all dues such as unpaid salary, bonuses, and any other payments are made within the stipulated timeframe.

In the absence of clear timelines, companies generally take around 30 to 45 days to settle FnF dues. The newly proposed Wage Code mandates that final dues should be settled within two days of the employee's last working day.

The Payment of Gratuity Act, 1972

Purpose: Regulates the payment of gratuity to employees who have rendered continuous service for five years or more.

Impact on FnF:

Employers are required to calculate and disburse the gratuity amount based on the last drawn salary and years of service.

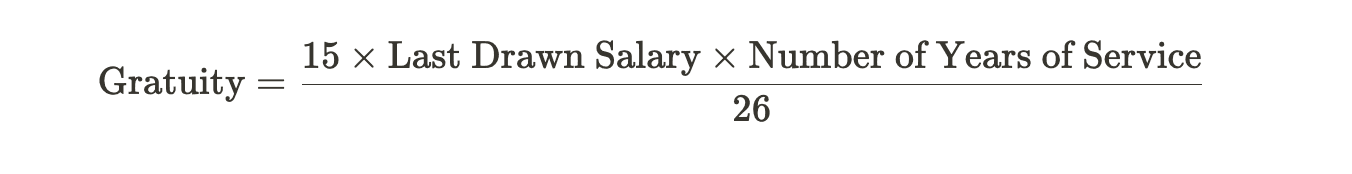

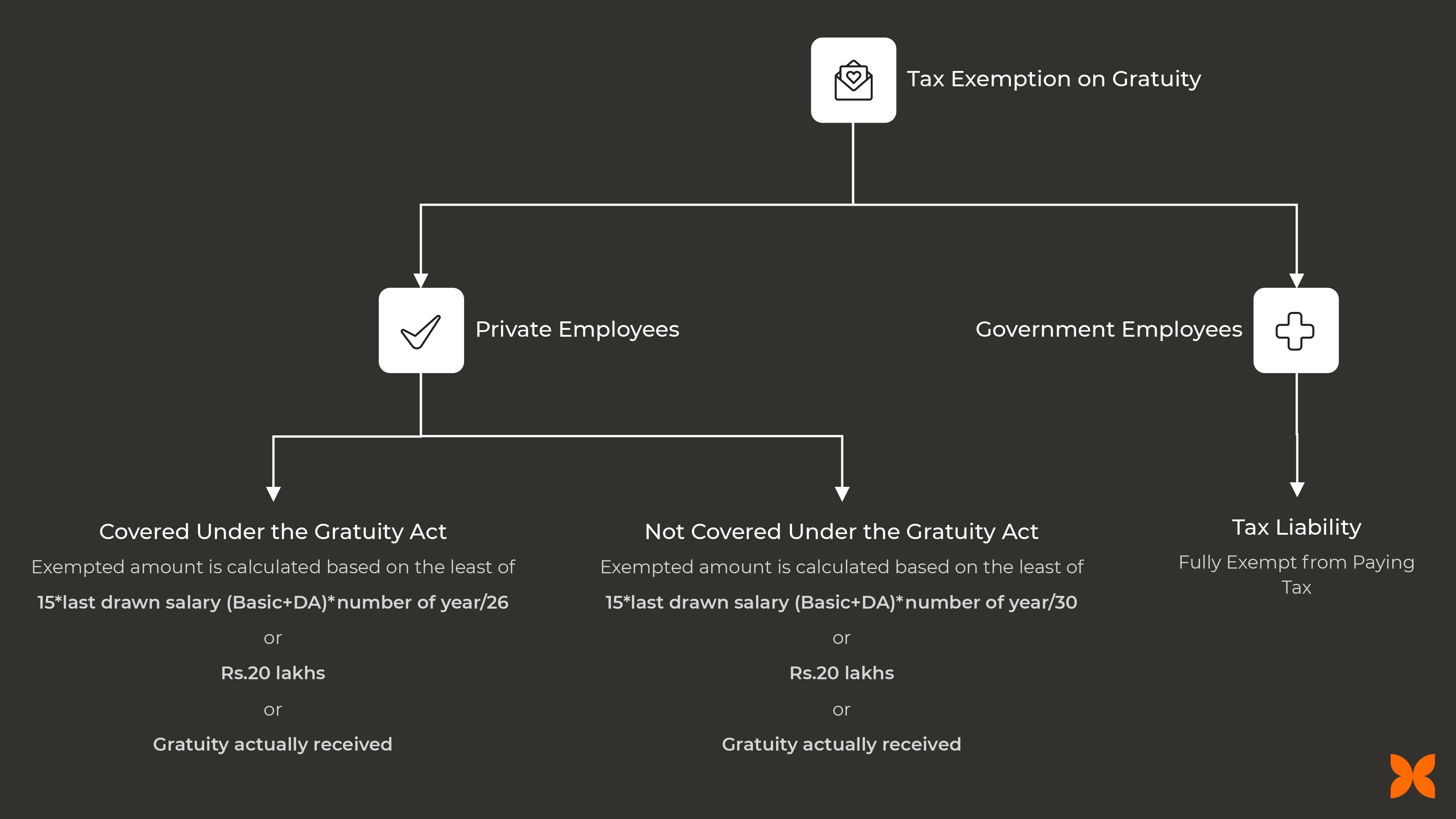

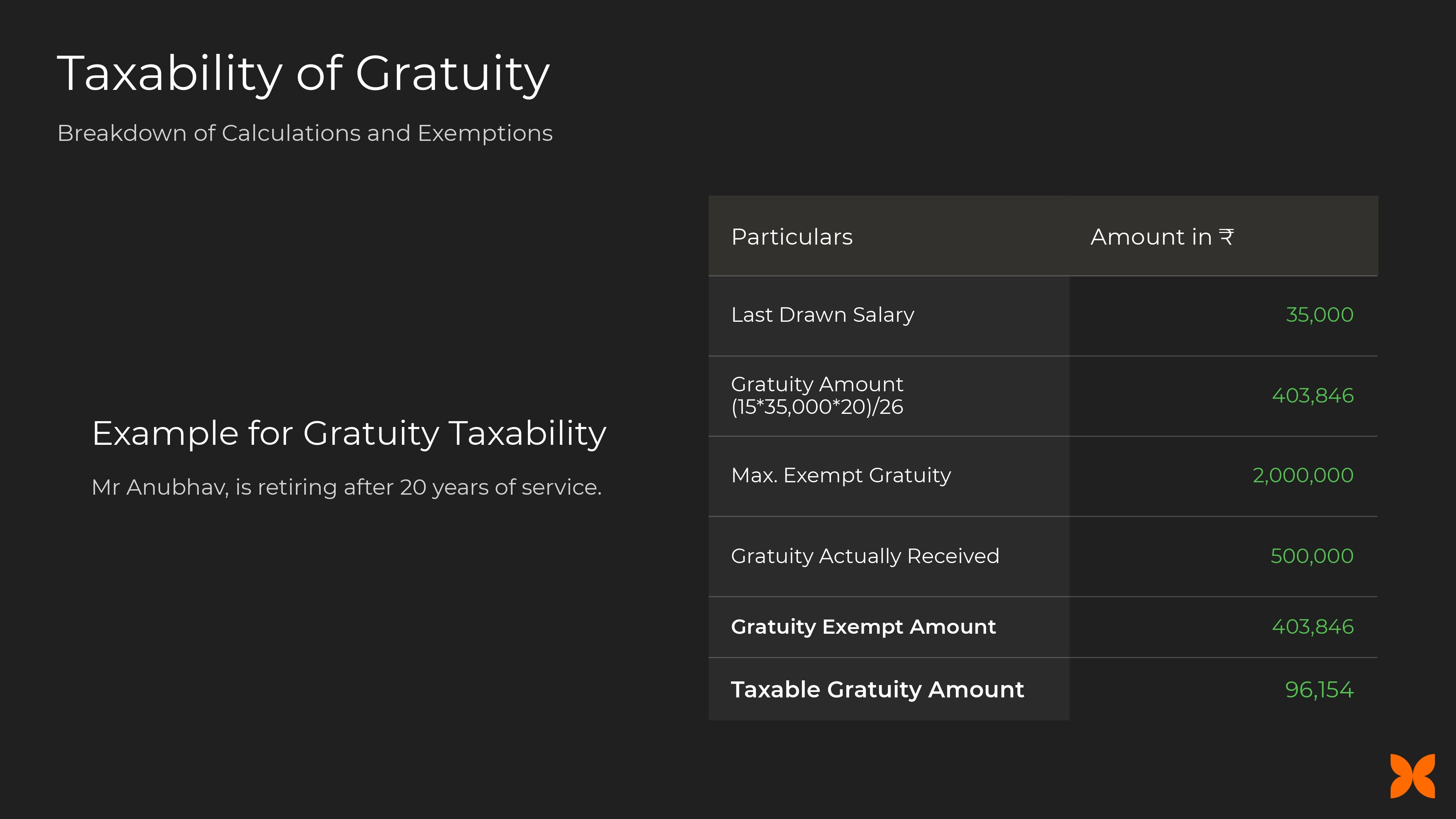

Tax exemptions on gratuity depend on whether the employee is covered under the Gratuity Act and the amount received.

The Employees' Provident Fund and Miscellaneous Provisions Act, 1952

Purpose: Ensures savings for employees to use post-retirement or during emergencies.

Impact on FnF:

Employers must update the exit dates on the EPFO portal to process the withdrawal or transfer of PF balances.

Any pending PF contributions must be settled before issuing the FnF settlement.

The Employees' State Insurance (ESI) Act, 1948

Purpose: Provides social security and insurance benefits to employees in case of sickness, maternity, or employment injury.

Impact on FnF:

Similar to PF, HR must update the exit dates on the ESIC portal.

Any pending ESIC contributions need to be cleared during the FnF settlement.

Related Articles

Impact of These Laws on FnF Calculation and Settlement Timelines

Timely Disbursement:

The laws emphasize the importance of timely disbursement of dues to avoid legal repercussions. While traditional timelines range from 30 to 45 days, the proposed Wage Code's two-day mandate, once implemented, will significantly reduce this period.

Accurate Calculation:

Miscalculations can lead to disputes and legal issues. Following the formulas provided under these acts for components like gratuity, PF, and leave encashment ensures compliance and fairness.

Statutory Deductions:

All statutory deductions such as TDS on salary, PF, and ESIC contributions must be accurately calculated and deducted in time as shown

Documentation:

Proper documentation is crucial to prove compliance. This includes maintaining records of salary calculations, gratuity payments, PF and ESIC contributions, and other statutory dues.

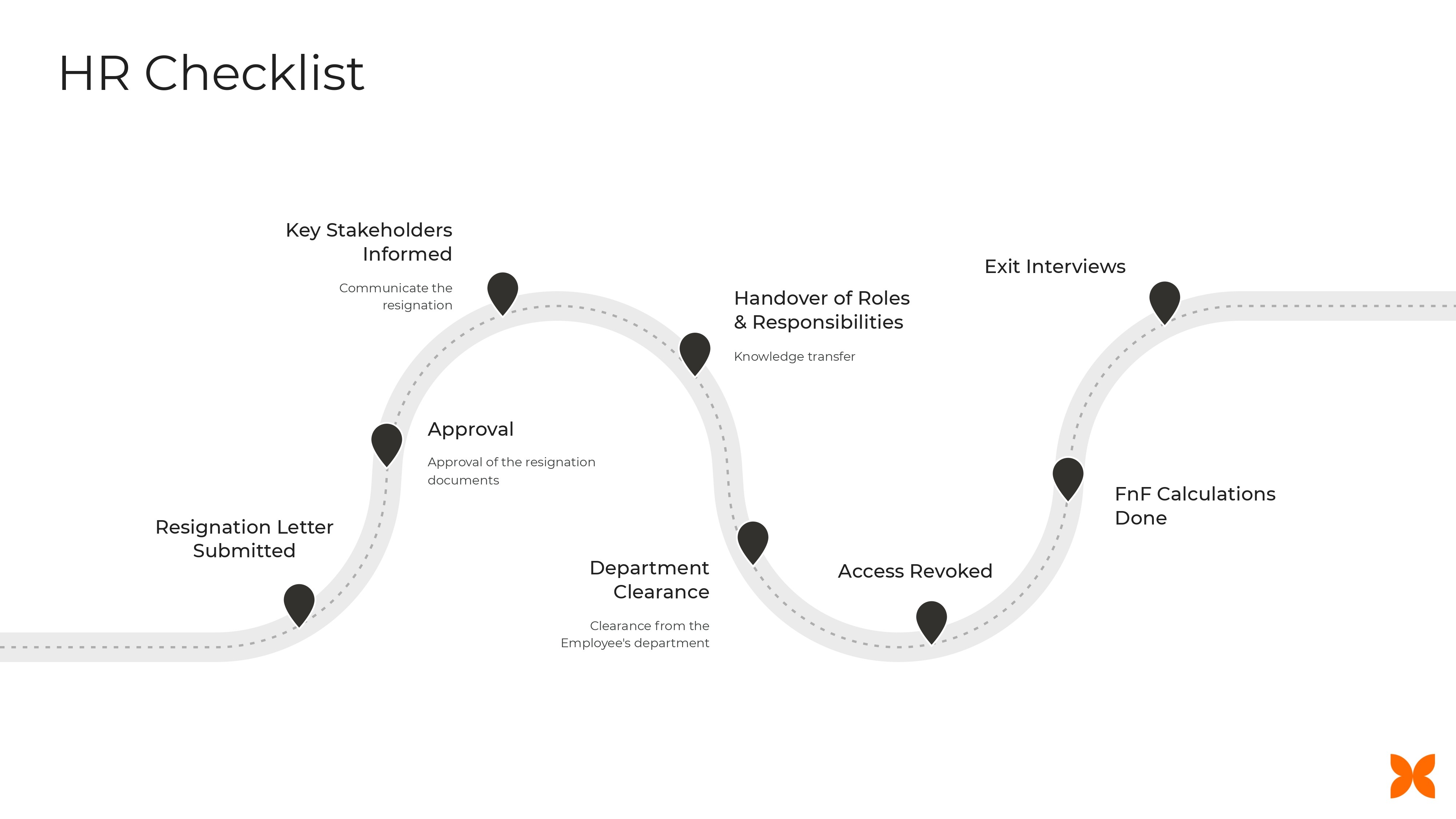

FnF Settlement Timeline and HR Checklist

The standard timeline for processing FnF settlements generally ranges between 30 to 45 days. However, with the proposed Wage Code mandating a two-day settlement period, organizations need to be well-prepared to expedite this process.

To streamline the FnF process, HR professionals should follow a comprehensive checklist to ensure all necessary steps are completed:

HR Checklist for FnF Process:

Receive Resignation Letter:

Acknowledge and document the resignation letter from the employee.

Approval Process:

Obtain necessary approvals from the respective department heads and management.

Communicate with Key Stakeholders:

Notify relevant stakeholders, including IT, finance, and the reporting manager, about the employee's exit.

Handover of Roles & Responsibilities:

Ensure a smooth transfer of responsibilities to other team members or the new hire.

Department Clearance:

Collect no-dues clearance from all relevant departments such as IT, admin, and finance.

Revoke Access:

Disable the employee's access to company systems, software, and premises to ensure security.

FnF Calculations:

Calculate all dues, including salary, bonuses, leave encashment, gratuity, and deductions, as per company policies and legal requirements.

Conduct Exit Interview:

Schedule and conduct an exit interview to gather feedback and insights from the departing employee.

This checklist helps ensure that the FnF process is conducted efficiently, transparently, and in compliance with all statutory requirements.

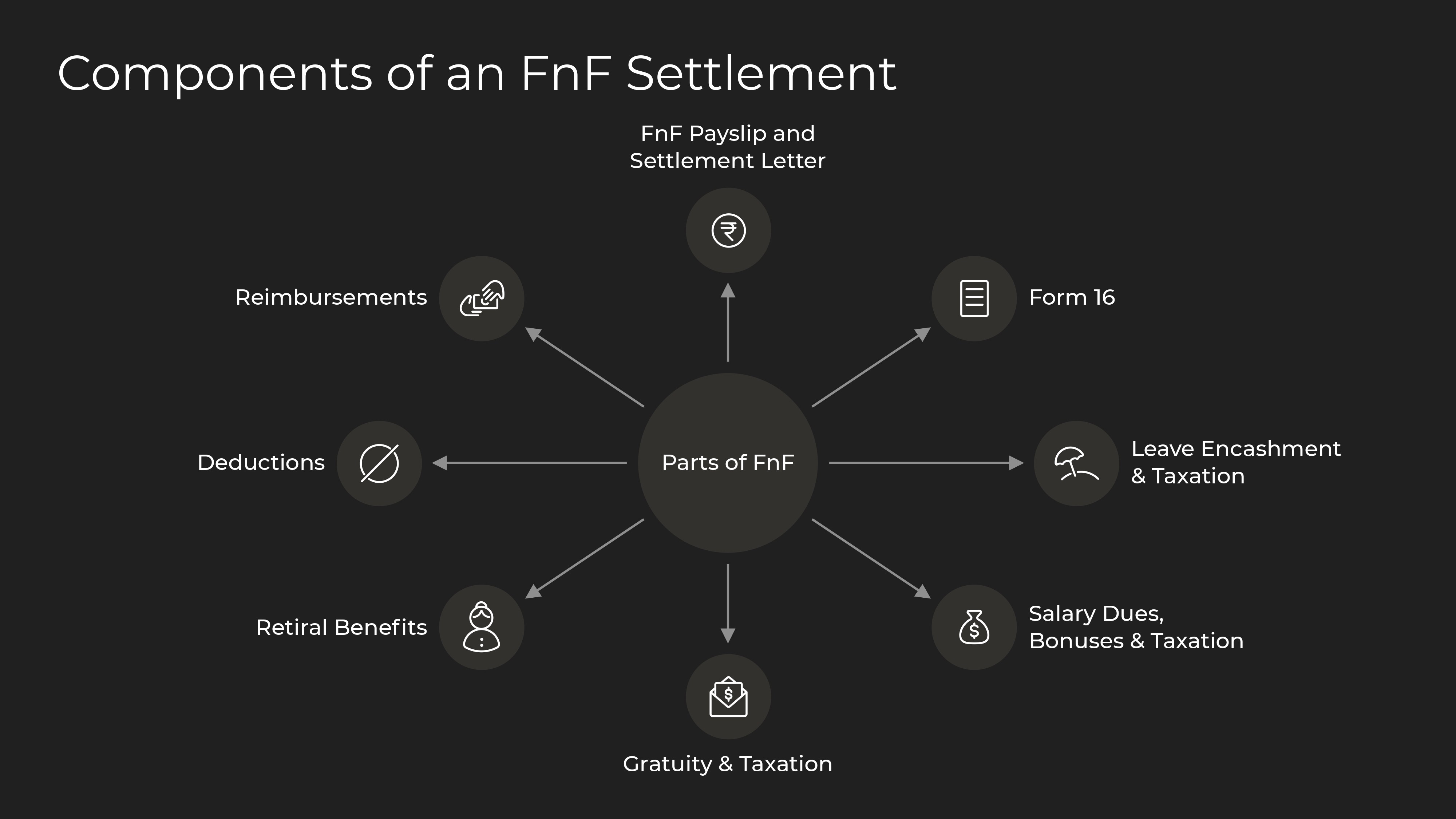

Components of the FnF Settlement

The Full and Final (FnF) Settlement process involves clearing all the dues owed to an employee at the time of their exit from the organization. This process ensures that both monetary and non-monetary elements are settled in a structured manner, complying with company policies and legal requirements. Below is a detailed breakdown of each component involved in the FnF settlement.

1. Salary Dues

Definition:

Salary dues refer to the salary amount owed to the employee for the days worked between their last salary payout and their last working day.

Example: If an employee worked for 12 days in a 26-day paid month with a gross salary of ₹52,000, the unpaid salary would be $\frac{12 \times 52,000}{26} = ₹24,000$

Tax Implications:

Salary dues are subject to Tax Deducted at Source (TDS) as per the employee's applicable tax slab rate. The TDS is deducted before making the final payout.

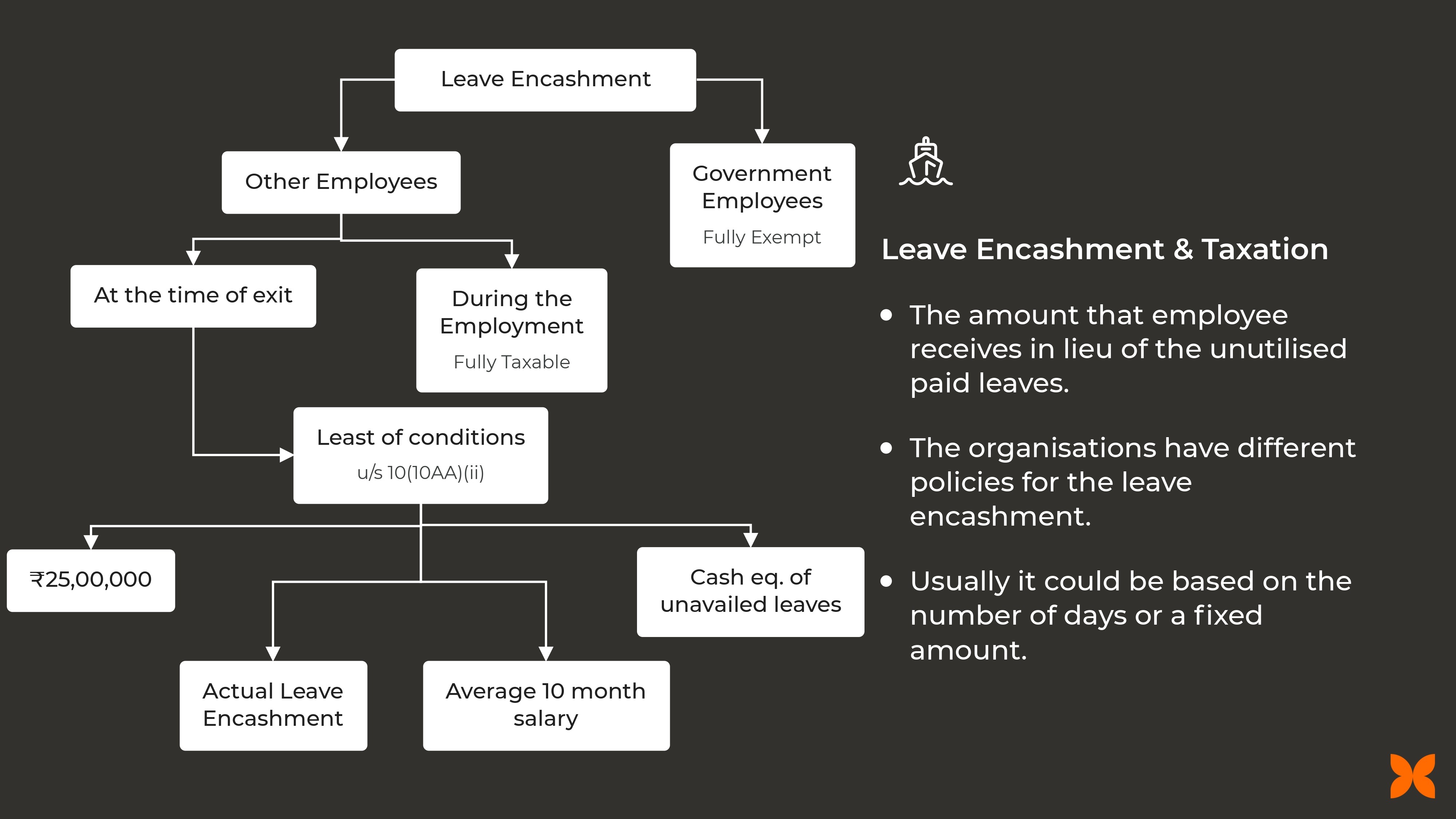

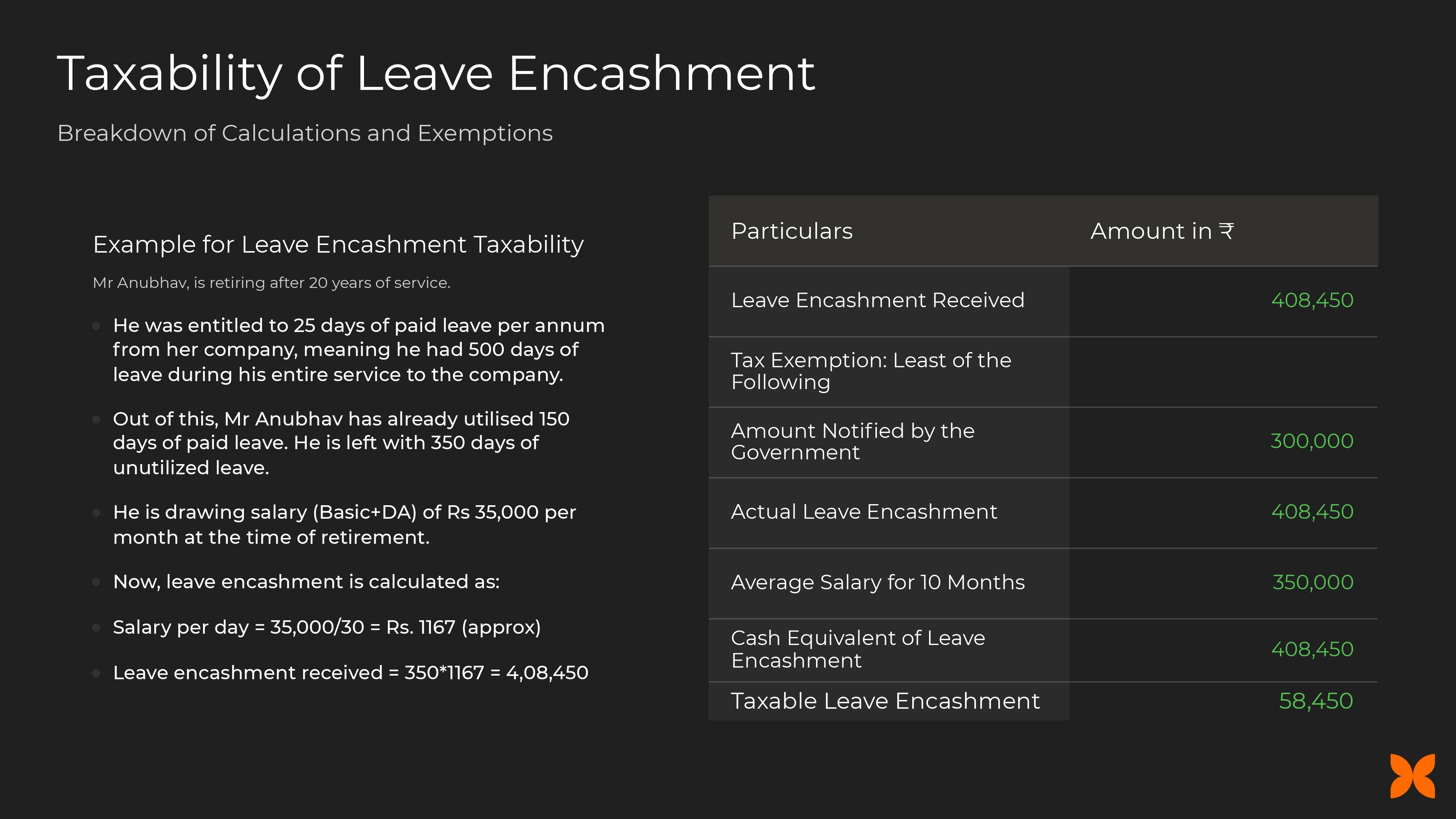

2. Leave Encashment

Definition:

Leave encashment refers to the payout for unused paid leaves accrued by the employee. Different companies have varied policies for leave encashment, which could be based on the number of days or a predetermined amount.

Example: For an employee with a monthly salary of ₹40,000 and 10 unutilized leave days, the leave encashment would be \frac{10 \times 40,000}{26} = ₹15,385

Tax Treatment:

During Employment: Fully taxable under the head of 'Salary.'

At the Time of Exit: Tax exemption up to ₹3,00,000 under Section 10(10AA) for non-government employees. Government employees are fully exempt.

3. Bonuses and Incentives

Definition:

Bonuses and incentives are additional payments made based on company policies, employee performance, or company profits.

Calculation:

Bonuses are generally calculated based on internal criteria, which may include performance metrics, sales targets, or profitability.

Tax Implications:

Bonuses are treated as part of 'Salary' and taxed according to the employee's applicable tax slab.

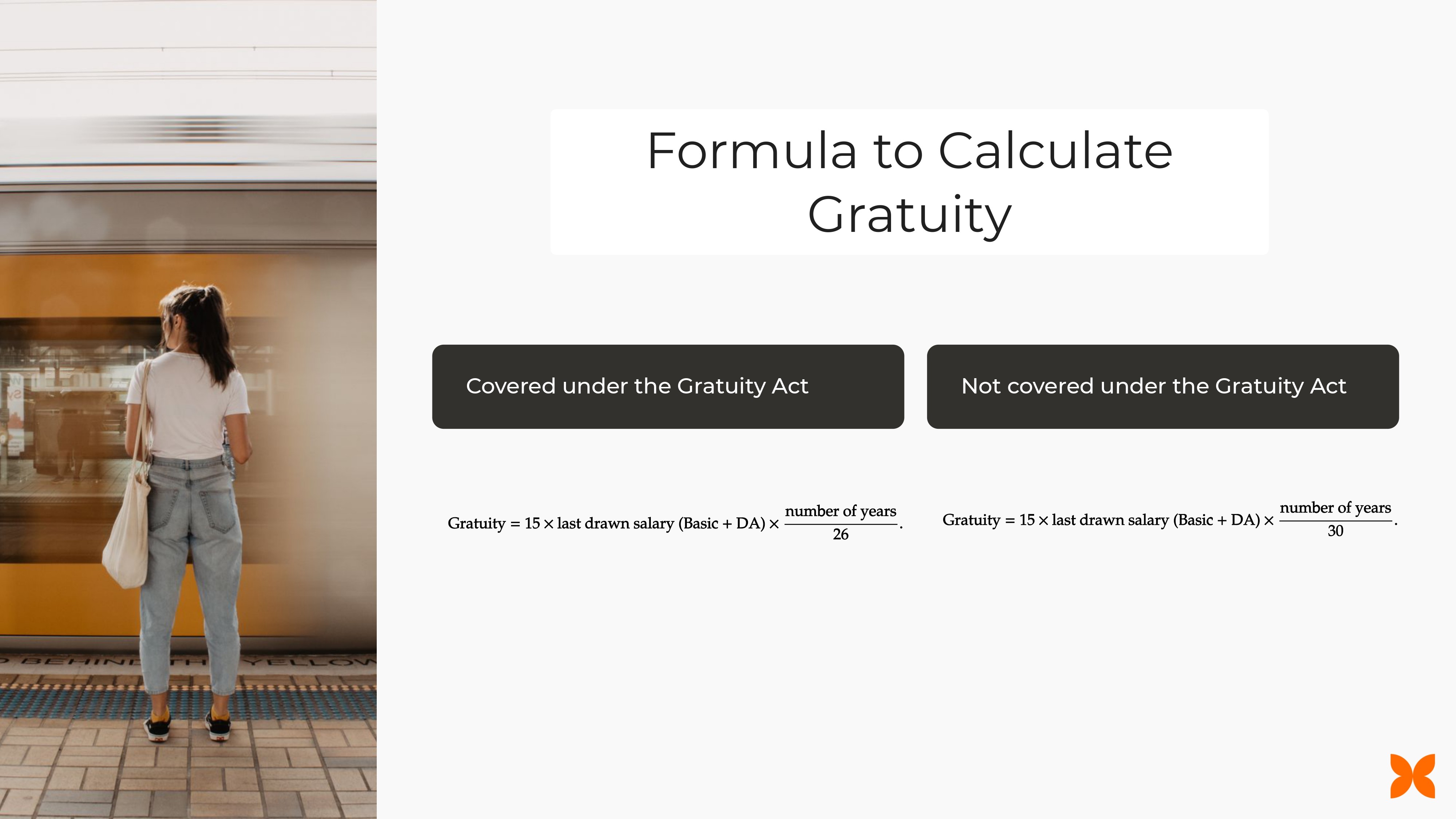

4. Gratuity

Definition:

Gratuity is a statutory benefit given to employees as a token of appreciation for their continuous service, typically applicable after five years of service.

Example: For an employee with a last drawn salary (basic + DA) of ₹30,000 and 10 years of service, the gratuity would be \frac{15 \times 30,000 \times 10}{26} = ₹1,73,076

Tax Exemptions:

Exempt up to ₹20,00,000 for employees covered under the Gratuity Act. Amounts beyond this are taxable under the head 'Salary.'

5. Retiral Benefits

Definition:

Retiral benefits include contributions towards the Employees’ Provident Fund (EPF), Employee State Insurance (ESI), and other similar retirement funds.

Procedures:

EPF: HR must update the exit date on the EPFO portal, and any pending EPF contributions must be settled.

ESIC: Similarly, HR needs to update the exit date on the ESIC portal to avoid future contributions and facilitate claim settlements.

Tax Implications:

Withdrawals from EPF are tax-free if the employee has completed five years of continuous service. ESIC contributions are not taxable but are essential for insurance claims.

6. Deductions

Types of Deductions:

Statutory Taxes: TDS on salary, bonuses, and other taxable components.

Unserved Notice Period: Compensation for the notice period not served by the employee, as per company policy.

Outstanding Loans/Advances: Any company loans or salary advances taken by the employee.

Damages to Equipment: Deduction for any damages or loss of company property.

Procedure:

All deductions must be calculated and communicated clearly to the employee to avoid disputes.

7. Reimbursements

Definition:

Reimbursements include any pending payments for expenses incurred by the employee on behalf of the company.

Tax Treatment:

Reimbursements are not considered as taxable income and should be excluded from statutory tax calculations.

8. FnF Payslip and Settlement Letter

FnF Payslip:

A detailed payslip is issued that includes all components of the FnF settlement: salary dues, leave encashment, bonuses, gratuity, deductions, and reimbursements.

Settlement Letter:

A formal letter is issued confirming that the employee has received all dues and has no further claims against the company.

9. Form 16

Definition:

Form 16 is a certificate issued by the employer containing the details of the employee’s earnings and tax deductions during the financial year.

Purpose:

It helps the employee in filing their income tax returns and serves as proof of income and tax deducted.

Each of these components requires careful calculation and adherence to legal and company policies to ensure a smooth and compliant FnF process. Proper documentation and transparent communication are key to avoiding disputes and maintaining a positive relationship with departing employees.

Conclusion

The Full and Final (FnF) Settlement process is a critical component of managing employee exits, ensuring that all dues are cleared and the transition is handled smoothly. Compliance with legal requirements, accurate calculation of components like salary, leave encashment, and gratuity, along with clear communication, are essential to avoid disputes and maintain a positive relationship with departing employees.

If you want to automate the mundane part of all the FnFs of your Organisations, don’t forget to check Craze out today.

FAQs

When should the FnF Settlement be paid?

Typically, within 30 to 45 days. However, the proposed Wage Code mandates settlement within two days of the last working day.

What if an employee disputes the FnF amount?

Clear communication and transparency in the calculation process are essential. Provide detailed explanations and legal backing for all components included or excluded.

Are gratuity and leave encashment always tax-free?

Gratuity is tax-free up to ₹20,00,000 for employees under the Gratuity Act. Leave encashment is tax-free for government employees and up to ₹3,00,000 for others.

What documents are required for the FnF process?

Resignation letter, no-dues clearance, FnF payslip, settlement letter, and Form 16.

What are the most common pitfalls in the FnF process?

Delays in processing, unclear communication, incorrect calculations, and failure to update statutory portals like EPFO and ESIC.