Automating payroll is a never-ending problem for startups and small businesses. Many startups and new-age companies still go the traditional route when transferring salaries to the employees’ accounts. Their typical payroll workflow looks something like this:

The HR/Finance team calculates salary tax deductions within the spreadsheet ➡️They log into the banking portal and transfer the salaries to each employee.

Imagine the manual work involved in this process, and there, too, is no guarantee of accuracy. Delays, wrong tax calculations and flawed salary components are widespread, leading to frustrated employees.

What’s the alternative?

Opt for the best payroll software in India that matches your use cases and gels perfectly with your team. We have shortlisted a list of payroll systems for startups. All you have to do is select the one best suited for your organisation.

Let’s get started.

Craze

Keka

RazorpayX Payroll

Zoho Payroll

Kredily

GreytHR

HROne

ZingHR

Qandle

Zimyo

According to a report published in InboxInsight, 46% of 250 HR decision-makers intend to learn more about an HR software’s payroll features before purchasing it.

That brings us to a question.

Which payroll features should you invest in for your startups?

When selecting a payroll solution for your business, looking beyond basic features and pricing is crucial. Here are the essential features that a comprehensive payroll software should offer:

User-friendly interface

One-click salary transfers for efficient processing

Seamless integrations with other HR and financial systems

Intuitive user experience for both administrators and employees

Compliance management

Automatic calculations for TDS, PF, ESI, and professional tax deductions

Up-to-date compliance with local and national regulations

Comprehensive reporting tools for statutory requirements

Scalability and flexibility

Accommodate your growing workforce, including full-time employees, freelancers, and consultants

Handle multi-currency payroll for businesses with international operations

Adapt to changing business needs without significant overhauls

Robust customer support

Reliable and responsive customer service

Comprehensive training resources for smooth adoption

Ongoing technical support for any issues that arise

Customisation options

Flexibility to customise salary components

Ability to create personalised features tailored to your team's needs

Adaptability to your unique business processes and payroll structures

Here’s a list of features keeping in mind both the employees and HR/Finance professionals:

Features for HR and Finance Professionals

A centralised database to store employee information such as bank account details and compensation breakdown, etc.

Automated payroll calculation based on working hours, leaves, tax eligibility and deduction, overtime, etc.

Updated local and state tax regulations for compliance

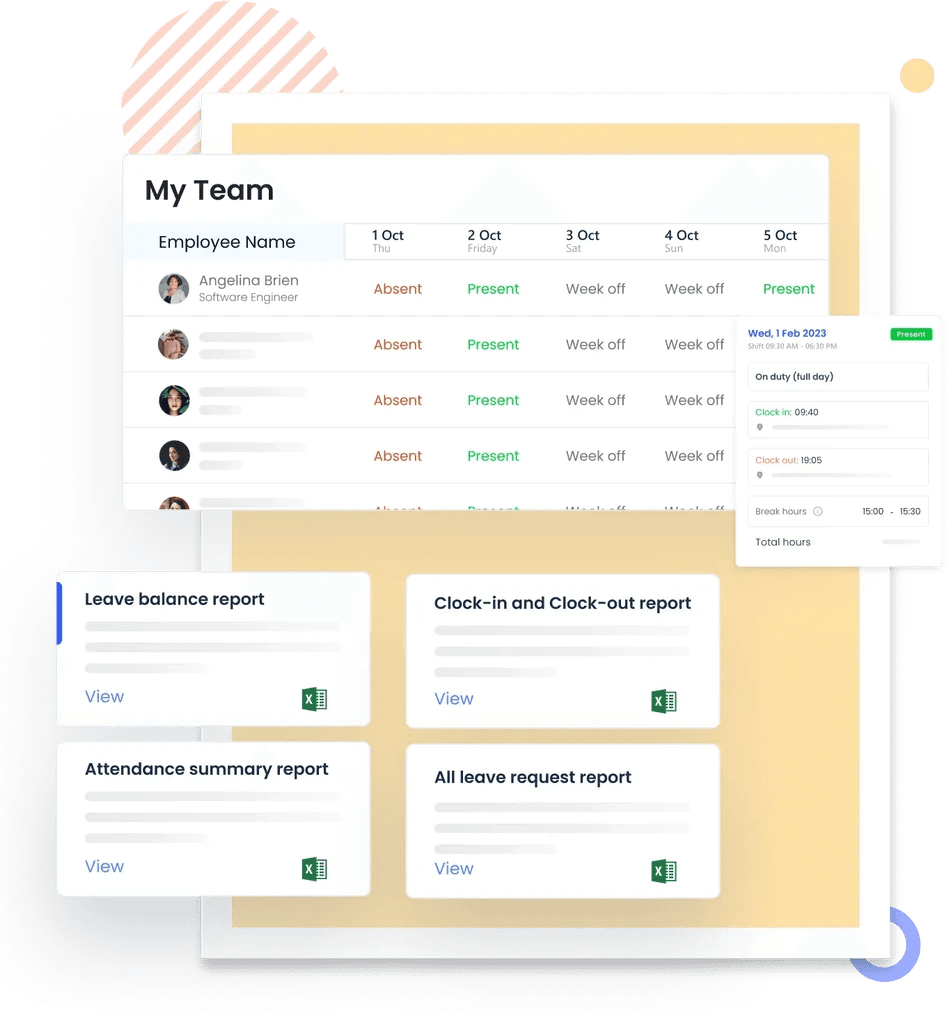

Time, attendance, and leave management system integration for easy tracking and salary calculation

Reporting and analytics, including standard payroll, salary analysis, overtime, pay type reports, etc.

Role-based access controls to protect sensitive employee information

Detailed payroll history and audit trail to track changes

Features for Employees

Self-service portal to access payroll information, view and upload tax deduction documents

Downloadable payslips and other documents with a detailed breakdown of deductions, allowances, etc.

Access to support resources like FAQs, helpdesk, and guides

Mobile app or mobile-responsive browser for easy payroll access

Now that you have a list of India's best payroll solutions, what’s next? It's time to consider aspects beyond features and pricing.

Ease of use: Assess the software for one-click salary transfers, seamless integrations, and user experience

Compliance: Check if the software handles payroll compliance requirements, such as TDS, PF, ESI, professional tax deductions, reporting, etc

Scalability: Make sure the payroll software scales with your growing business, accommodating more full-time employees, freelancers and consultants, and its ability to handle multi-currency payroll

Customer support: Test if the software vendor has reliable and responsive customer support. Check for training resources to help with tool adoption

Customisation: Assess the vendor’s flexibility to customise salary components or other personalised features that your team might need

Let us now take you through the best payroll systems for SMEs. Before that, here’s a glance at our top three picks. It is based on their features and startup-friendly pricing.

Tool name:

Craze

Pros: All-in-one HR, Finance and Compliance, custom salary components and super-fast support

Cons: No mobile application, but the web application is efficient enough

Ideal for: For startups and SMEs with less than 100 employees looking for advanced payroll features

Starting price: ₹100/ person/ month with no minimum user commitment and feature gating

Zoho Payroll

Pros: Intuitive UI and payroll structure customisation

Cons: There is no feature to run payroll in batches. Live chat and support need improvement

Ideal for: SMEs looking for basic payroll process automation

Starting price: ₹75/ employee/ month for at least 25 employees, effectively ₹3750 with email and voice support only

HROne

Pros: Easy to process payroll and simplified calculations

Cons: Limited customisation and slow page response

Ideal for: Small businesses with 50+ employees seeking basic payroll management

Starting price: The basic plan at ₹85/ user/ month, doesn’t cover all use cases

Here are more detailed features, pricing, and use case breakdowns for the best payroll software in India. In addition to our analysis, we have relied on review portals like G2 and Capterra to identify the tools' pros and cons.

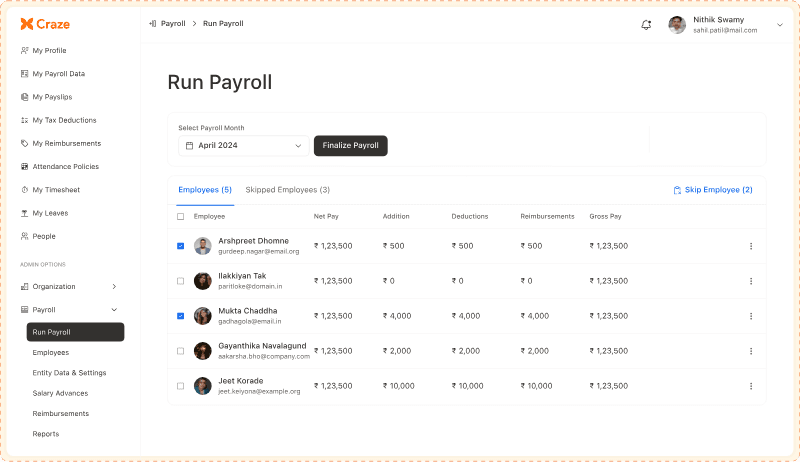

Craze

Craze is one of the newest players on the block, but it is on our list of the best payroll systems for small businesses for a reason. The best thing about Craze is that it is simple and built for startups who struggle with spreadsheets or want to switch from clunky and confusing systems. The pricing is a cherry on top, the most flexible on this list.

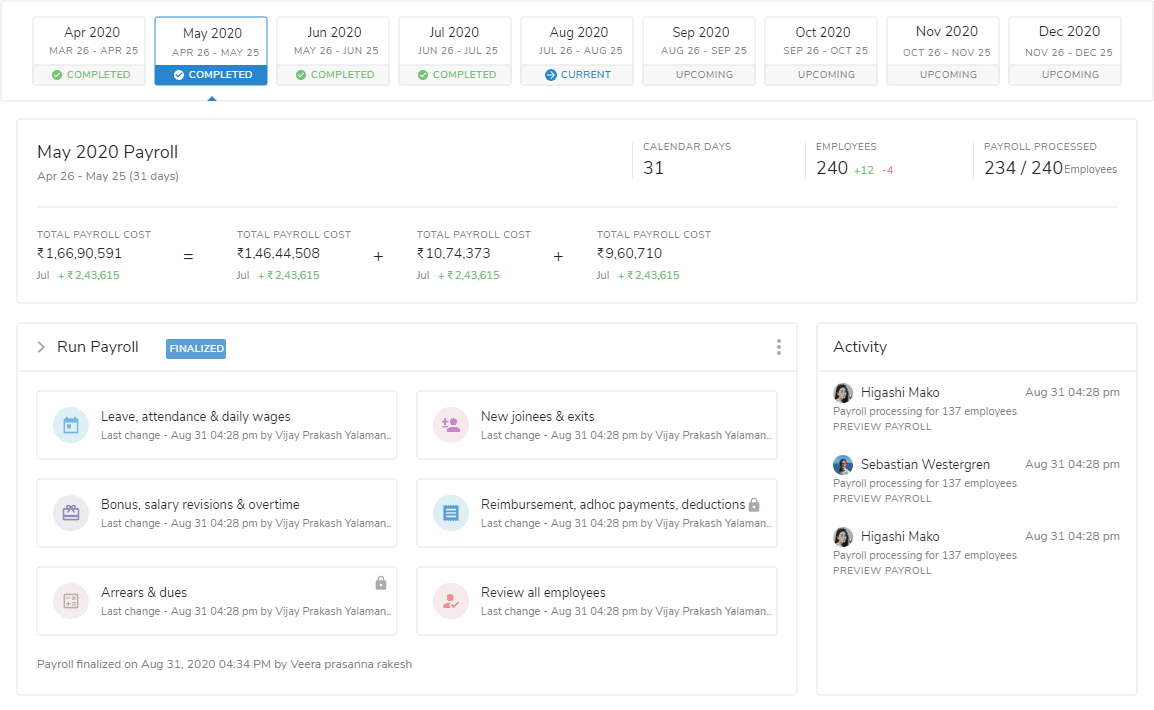

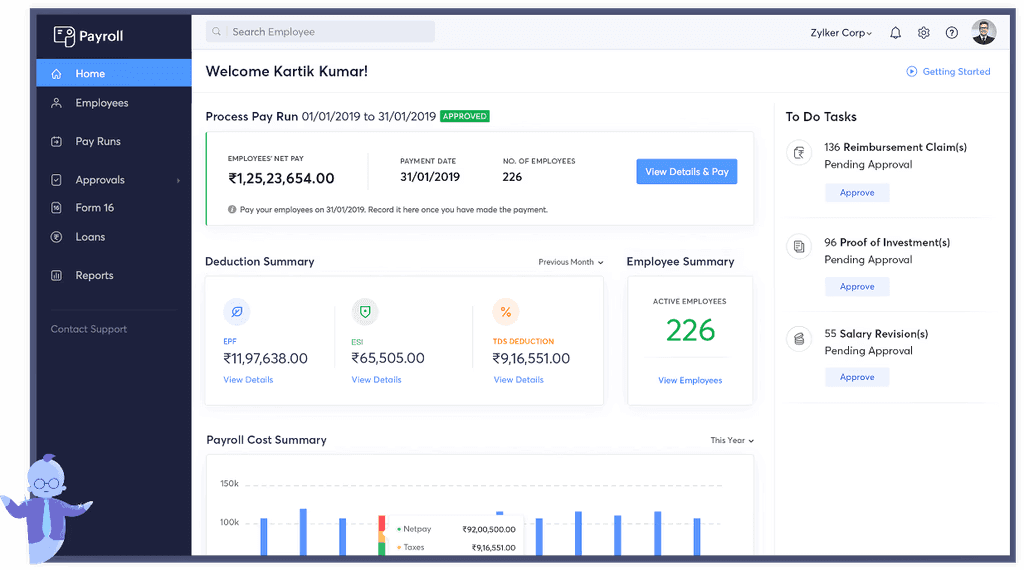

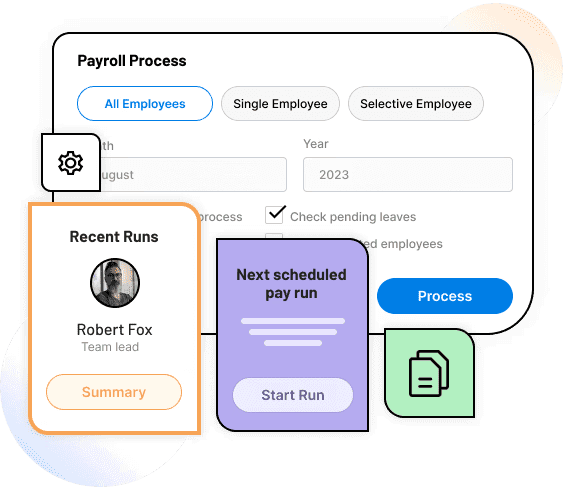

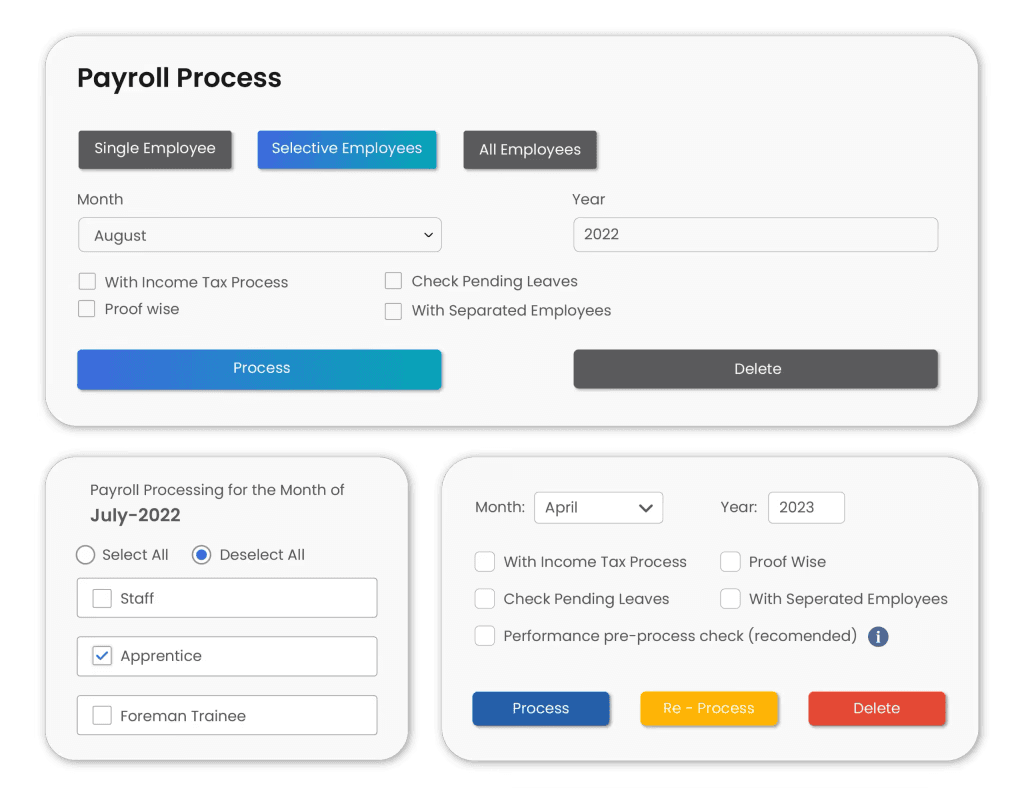

Craze’s one-click payroll software reduces the back-and-forth of your finance and HR team and the excess effort they spend logging in to the bank account and manually processing salaries. All you have to do is insert the month you are processing the payroll and click on ‘Process Payment,’ and you are good to go.

HR/Finance professionals and employees can calculate tax compliances such as EPF, ESIC, TDS, and PF and download Form 16 from the same portal without remembering any tax regulations or performing any manual calculations. Simply turn on the compliances you want to apply, and your job is done.

Craze efficiently syncs with built-in leave management, Core HR, and attendance management tools to calculate custom salary structures for each employee without the HR team having to track any records or leaves within a spreadsheet. Craze also supports contractor payments, and you can process payments from freelancers, interns, and consultants using the same dashboard.

Craze best features

Automated one-click payroll compatible with any existing bank account — no integration required

Ensure error-free, tax-compliant employee salaries and contractor payments

Generated automated tax reports, managed bonuses and disbursements within Craze’s intuitive dashboard

Sync leaves and attendance effortlessly to ensure updated and accurate salary processing

Support for multiple salary structures as per team or departments and flexible benefits plan

Preview payslips for employees

Pros

Super-fast support from SMEs to address all your specific payroll-related queries

Employee-friendly software, easy to set up and takes only 24 hours to process your first payroll

An all-in-one people operating system where you can manage payroll, leaves, attendance, tax, employee database and all other HR and finance operations without switching between applications

Startup-proof, per user-per-month pricing, no feature gating

We completed onboarding in under half a day and processed payroll within 24 hours of our initial conversation. Craze makes tasks much easier compared to other disconnected solutions. Excel sheets are cumbersome and prone to errors, but Craze solves these issues. My experience has been excellent! I highly recommend Craze.

Cons

Craze doesn’t have a mobile application yet, but the web application and its simplicity make up for it

Ideal for: SMEs and startups with team sizes less than 100 looking for a simple yet advanced payroll software with an affordable pricing plan and absolutely no feature-gating

Pricing

Growth: The Core, the base layer for all other apps, is ₹40/month/person. The Growth Plan costs you ₹60/month/person ****with no setup fees or support fees, accommodates unlimited employees, and gives you access to all the payroll features mentioned above. The cost of using the payroll software is effectively ₹100/month/person

Enterprise: The Enterprise plan is suitable for enterprises with 100+ employees looking for specific features for their custom use cases, and the Craze team creates personalised pricing plans accordingly

Keka

Keka's payroll management system automates payroll processes to reduce payment errors, simplify payroll operations, and ensure timely salary credit.

Keka best features

Configurable salary structure

Payroll preview before final release

Integrated expense management with custom approval workflows

Explore Keka features in this detailed Keka Review 2024.

Pros

Accurate tax declarations and data visibility

Easy to access and use payment records

Hardik B - “ One of the best payroll management software solutions is an all-in-one employee management tool. It manages IT returns, stores the entire history of salary slips, and allows employees/manageer to set up one on one meetings directly in Keka or through integrated Microsoft Teams feature. It's easy to use, and I love using it frequently.” Source

Cons

Inadequate reading materials and support for beginners

Mobile app UI requires improvement

Hardik B - “ Many times, the performance of Web Keka suddenly drops, making it inaccessible during office hours. In my experience, the mobile app is to consume more data and often runs slowly on mobile networks.” Source

Ideal for: Mid-sized businesses and enterprises with high budgets looking for payroll automation

Pricing

Foundation: ₹9,999/month for up to 100 employees and ₹90/month for each extra employee. No access to employee self-service

Strength: ₹12,999/month for up to 100 employees and ₹120/month for each extra employee with feature lock-ins

Growth: ₹15,999/month for up to 100 employees and ₹150/month for each extra employee. Access all payroll and Core HR features

RazorpayX Payroll

RazorpayX Payroll is an automated payroll and compliance software for HR managers, payroll administrators, and employees. The platform simplifies payroll processing with automatic salary deposits and tax payments.

RazorpayX Payroll best features

Automatic salary calculation and direct transfer to employee bank accounts

Self-serve employee dashboard for payslips, Form 16, and investment declarations

Payroll auto-sync with attendance and leave management for error-free salary disbursements

Learn more about RazorpayX Payroll features in this detailed RazorpayX Payroll Review 2024

Pros

Easy-to-use and compliant payroll processing

Automatic calculation of deductions and bonus

Paramjit S - “ Payment processing is very easy, many payment options like credit card, wallet, upi and netbanking etc.” Source

Cons

Limited report generation features

There is no feature to download Form 16 mid-year

Lack of robust Leaves and Attendance products

Ayushi A - “ Razorpay customer support is unsatisfactory as it takes longer to resolve raised tickets**.**” Source

Ideal for: SMEs and enterprises ****looking for comprehensive payroll management features

Pricing

Prime: ₹2999/month for up to 20 employees with basic payroll features

Elite: ₹5999/month for up to 50 employees and ₹100/employee/month for extra employees. Access to advanced payroll but limited expense management features

Enterprise: Custom pricing plan best for teams of 100+ employees

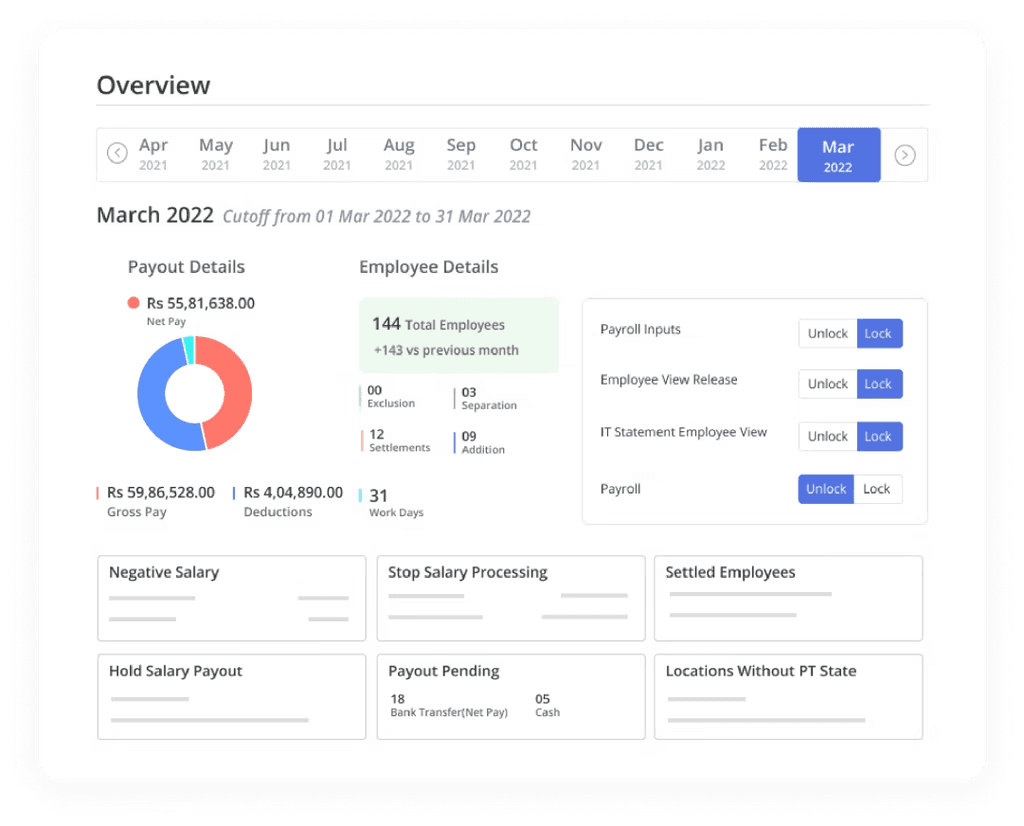

Zoho Payroll

Zoho Payroll is a tax-compliant payroll software for India. The tool automates payroll calculation and statutory compliance. It also provides employee self-service to enable collaboration between employees and payroll teams.

Zoho Payroll best features

Automate payroll calculation and generate payslips with detailed tax, allowance, and deduction breakdown

Customisable pay slabs for different employee groups

User roles and role-based access for security

Pros

Clean and intuitive UI

Customisations for unique payroll structures

Shradha J. ****- “ Ease in operating. It is user friendly. Easy to integrate with other Zoho Applications to track. Good support from the zoho whenever required . You can implement this sofware easily with large group.” Source

Cons

The feature to run payroll in batches is missing

Live chat and support features could be better

Sunil Y.- “ The missing feature which acccording to me lacks is running payrolls in batches.” Source

Ideal for: SMEs looking for basic payroll system automation

Pricing

Free: ₹0 up to 10 employees with basic payroll features

Standard: ₹50/employee/ month for at least 25 employees. No access to advanced payroll features like custom user roles and access controls

Professional: ₹75/employee/month for at least 50 employees. Get access to payroll features

Kredily

Kredily is a payroll software that enables custom salary configurations and automates compliance tasks like tax calculations.

Kredily best features

Customisable salary structures to align with company needs

Automated overtime wages and tax deduction calculations

Mid-month variable payouts for flexible employee compensation

Learn more about Kredily’s leave management features in this Kredily Review 2024.

Pros

Easy-to-use interface

It is easy to generate payslips and approve expenses and payouts

Komalpreet K. - “ I had a fantastic experience using the portal; It helped the organization in every way to maintain data and keep track of every employee and his/her details, I am suggesting it to my friends also.” Source

Cons

Custom support is not responsive

Login issues and the free version is buggy

Akash N. - “The only issue I feel needs attention is, that we get logged out automatically from the website after some time of inactivity or closing the website. Every time we close the tool we have to log in again.” Source

Ideal for: Mid-sized businesses and enterprises with custom payroll needs

Pricing

Free forever: ₹0/Month with one customisable salary structure and basic payroll features

Professional: ₹1499/Month for up to 25 employees and ₹60/employee extra from the 26th employee. Payslip bulk download and IT computation are available as add-ons

Enterprise: Custom pricing

GreytHR

GreytHR best features

Automate PF calculations with ECR generation

Employee Self-Service (ESS) portal to improve employee experience

Payroll analytics and custom reports to make informed decisions

Explore the payroll processing features of GreytHR in this detailed GreytHR Review.

Pros

Intuitive UI

Prompt customer support

Nisha K. - “ I am using GreytHR since 2021 as an HRMS system. The maine thing i like about this software is accuracy, speed, wide solution related to any type of query and last but not least easy to use by me as well as employees.” Source

Cons

Lagging site response time

Sometimes, system log-in takes time. It lets you log in after many attempts

Sumit A. - “ Despite being largely intuitive, the user interface is a little conjusted. It is difficult to integrate with other systems. It has some performance issues as well.” Source

Ideal for: SMBs seeking basic payroll features to automate salary calculation and disbursement

Pricing

Starter: ₹0/month for 25 employees and access to basic payroll features****

Essential: ₹3495/month for 50 employees and ₹30/month/employee for extra employees

Growth: ₹5495/month for 50 employees and ₹60/month for each extra employee. Add-on pricing for business expense claims management

Enterprise: ₹7495/month for 50 employees and ₹100/month/employee for extra employees

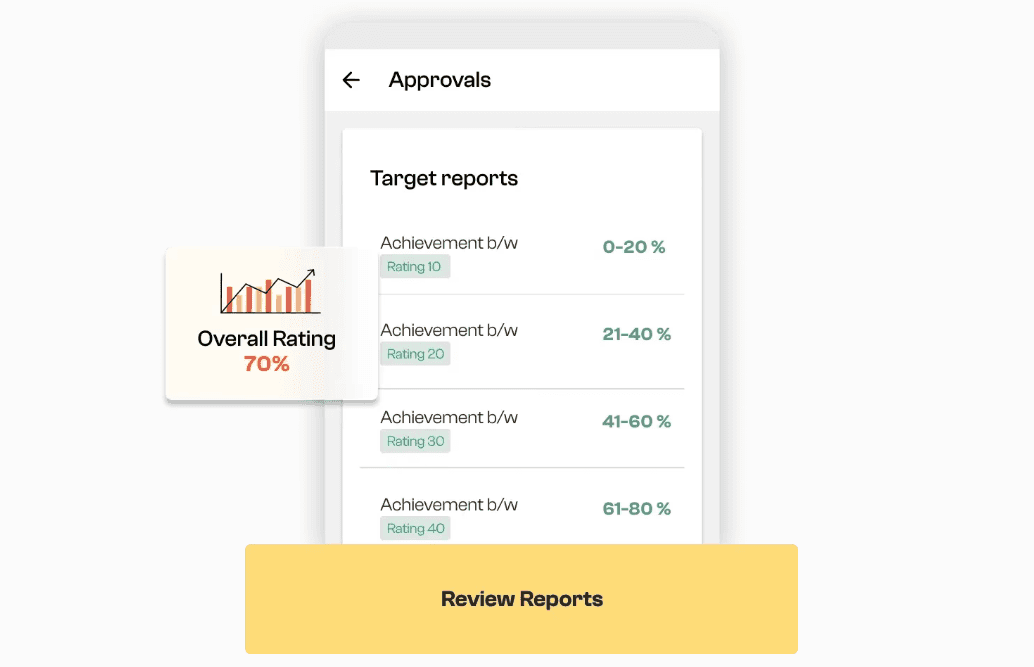

HROne

HROne is one of the best payroll software for small businesses to ensure timely payouts. The platform simplifies payroll management by automating CTC calculation and salary verification.

HROne best features

Detailed 3D reports for salary breakdown, overview, and month-wise trends

Employee self-service portal for payroll access and self-proposed declarations

Compliant requirements checklist and auto deductions of ESI, PF, etc. for statutory compliance

Get more insights into HROne features in this detailed HROne Review.

Pros

It is easy to process payroll through the mobile app

Simplified arrear and increment calculations

Sakina N. - “ HROne is a unique and simplest software i had ever used. It has all the features available which makes day to day operations easy for company thats why i called it as all in one.” Source

Cons

Limited customisation in reports and dashboards

Slow page response after system updates and errors while uploading files

Sakina N. - “ Few things needs some improvement which we feel such as reports needs to be more accurate majorly the leaves reports. They also start focusing on the policy which are follow by international companies.” Source

Ideal for: Small businesses looking for a basic and affordable payroll system

Pricing

Basic: ₹85/user/month with access to payroll features

Professional: ₹115/user/month with limited access to core HR and workforce features

Enterprise: Custom pricing

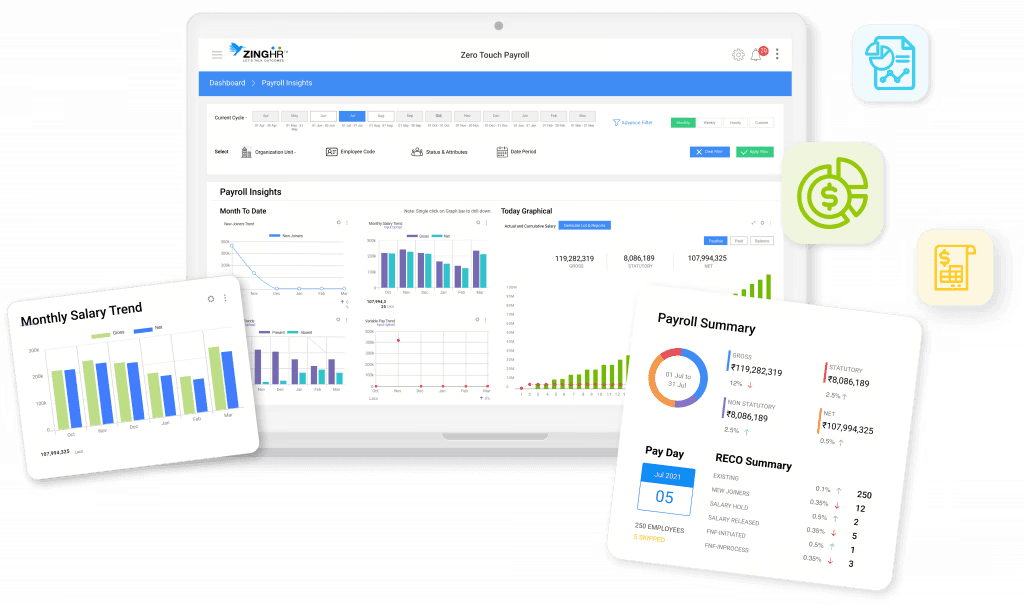

ZingHR

ZingHR is an HCM (Human Capital Management) platform that provides payroll management services. The tool helps access real-time payroll data and track salary disbursements and compliances.

ZingHR best features

CXO dashboard for visibility into payroll processes

In-built analytics for pay rates overview, monthly trends, tax insights, etc.

Tax filing services to streamline employee taxes

Pros

Easy to download payment slips and investment submissions

Comprehensive monthly and cumulative salary statements with allowance details

Aryan D. - “Lots of thing are easy to perform in this wether it is new member information or employee birthday/anniversary. Easy to download payment slips and Tax Simulation and investment submissions.” Source

Cons

Sometimes, the dashboard does not respond. It takes several refreshes to mark leaves or attendance

Outdated UI that requires improvement on different aspects for better user experience

Aryan D. - “we use once in a month and imagine dashboard loads really slow and multiple refresh just to mark WFH and leaves.” Source

Ideal for: Enterprises with a large workforce seeking comprehensive payroll management features

Pricing

Not available on the website

Qandle

Qandle is a centralised HR and payroll records platform. It automates payroll processing and employee reward compensation plans and optimises salary structures.

Qandle best features

Real-time payroll reports, including pay rates, employee data, payroll history, tax contributions, etc.

Reimbursement approval workflows

Incentive compensation plan calculation

Pros

Intuitive and customisation-focused

It is easy to calculate employee hours and work for performance evaluation

Subham Kr B. - “A nice and attractive user interface, very friendly also easy to use.” Source

Cons

Requires frequent software updates

The site is slow sometimes and takes long to process a page

Subham Kr B. - “Sometimes Qandle got stuck.” Source

Ideal for: Mid-sized businesses and enterprises looking for core HR and payroll features

Pricing

Foundation: ₹2950/month for up to 50 employees and ₹59/month per extra employee. No access to visual analytics and strategic HR features

Regular: ₹4950/month for up to 50 employees and ₹99/month per extra employee with feature lock-ins

Plus: ₹6200/month for up to 50 employees and ₹124/month per extra employee. Limited strategic HR features

Premium: ₹8000/month for up to 50 employees and ₹160/month per extra employee. Access all features except the remote toolkit

Enterprise: Custom pricing plan best for 1000+ employees

Zimyo

Zimyo is an AI-powered HRMS platform for payroll processing. The tool automates salary calculation and disbursement to reduce payroll errors.

Zimyo best features

Automated tax deduction and TDS, PF, and ESIC calculation

Custom expenses/ reimbursements approval workflows for expense management

Benefits management features, including instant personal loans and insurance coverage

Pros

Comprehensive payroll management features contributing to organisational efficiency

Payroll features are available for front users and admin, reducing payroll errors

Manisha M. - “Easy to use software with comprehensive features. I really like the real-time attendance tracking of employees, payroll automation, intuitive HR Analytics, and real-time performance tracking.” Source

Cons

Software bugs that often lead to frozen screens and functional complexities

Tax calculations vary every month

Anurag M. - “Some bugs are still there which sometimes freezes the screen and results in difficult situations and complexities sometimes.” Source

Ideal for: SMBs with 50+ employees looking for basic payroll automation tools

Pricing

Basic: ₹80/user/ month with least billing for 40 users and no access to advanced HR features

Standard: ₹120/user/ month with least billing for 40 users. No access to expense and benefits management and other features

Enterprise: ₹125/user/ month with least billing for 40 users. No access to payout features like error-free salary disbursement, available as add-ons

Here are a few more payroll software for small businesses and startups to explore:

PocketHRMS

PocketHRMS is an AI-powered HRMS platform offering automated payroll processing solutions to streamline salary calculations and disbursements.

PocketHRMS best features

Easy to use and intuitive UI

Helpful for maintaining employee data records and payroll processing

Pros

Comprehensive payroll management features

User-friendly interface for admins and employees

Flexible customisation options

Ashraf S - “ Pocket HRMS is Very useful and easy software to do Payroll and very useful to maintain employee data and we can download reports as per our convient at any time as it” Source

Cons

Slow response time

Poor customer support

Rajnish K. - “ Slow response, TAT needs to be followed, can do better with support, the team needs more clarity on the product front.” Source

Ideal for: SMBs and enterprises with 50+ employees seeking advanced payroll automation and HRMS features

Pricing

Standard: ₹2495/month (up to 50 employees), then ₹40/employee/month

Professional: ₹3995/month (up to 50 employees), then ₹80/employee/month

Premium: Custom pricing

Darwinbox

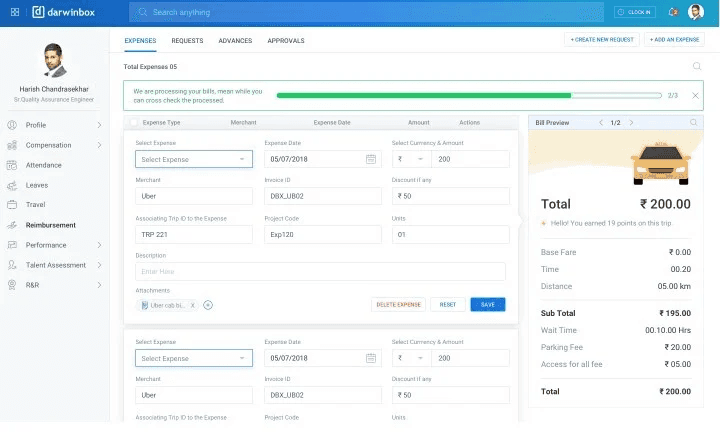

Darwinbox is a comprehensive HR technology platform offering an innovative "One Touch Payroll" solution. Within its broader HCM suite, it provides a seamless, integrated approach to payroll management.

Darwinbox best features

Global framework with RIVeR methodology for simplified payroll processing

Four-step process covering all pay groups in one system

Integrated HCM, WFM, and payroll for accurate and easy payroll management

Suitable for businesses of all sizes, regions, and departments

Pros

Simple and smooth, day-to-day payroll automation tool

Loads faster and easy to navigate platform

Numaan Q- “ Fast loading time and easy navigating buttons” Source

Cons

Incomplete notifications

Mobile app lacks important features

Robin S. - “ The web application has more features than the mobile app, which makes it annoying for users who prefer to use the mobile app more.” Source

Ideal for: Enterprises of all sizes seeking a comprehensive, integrated HR and payroll solution, particularly those with complex payroll requirements or global operations.

Pricing

Undisclosed

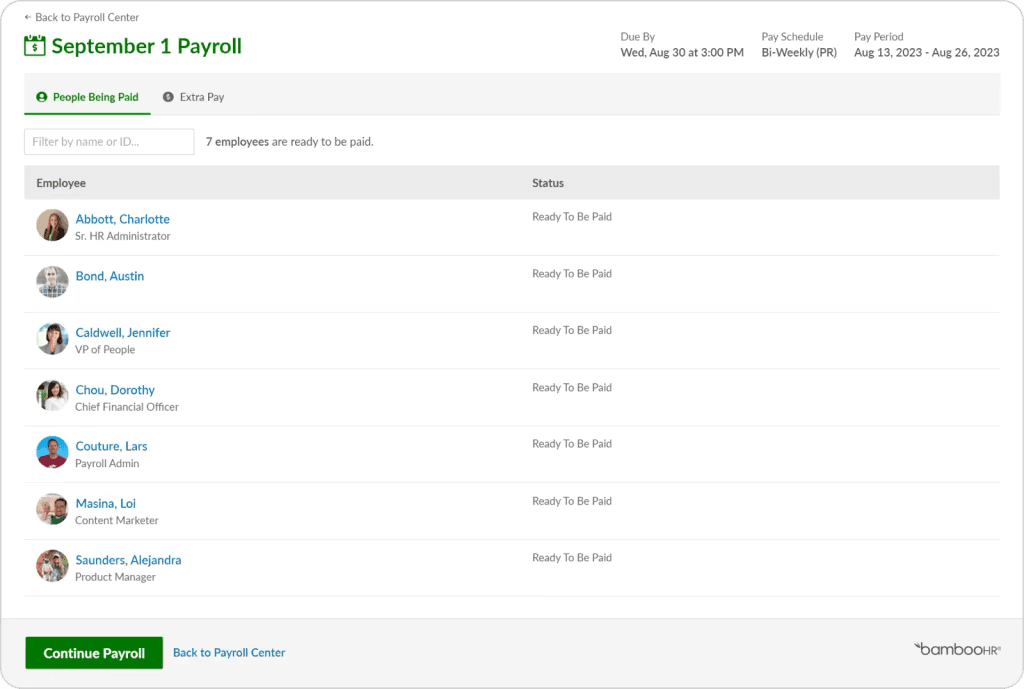

BambooHR

BambooHR is a comprehensive HR platform offering an integrated payroll solution designed for fast, easy, and accurate paydays. It provides a seamless approach to payroll management within its broader HR software suite.

BambooHR best features

Extensive reporting capabilities with customizable access levels

Employee self-service for pay stubs and information updates

Multi-rate payroll for tracking multiple job rates within an organisation

Streamlined implementation process with dedicated specialist support

Pros

Intuitive and easy to use

Easy to set-up

Deb L.- “ Easy to set up, implement and use for Admins and End Users alike. Staff is responsive and very friendly.”

Cons

Preparing reports is challenging

More new and customisable features can be added

Valentina J. - “ Overall, BambooHR is amazing, even though I believe there is a lot of room for new feautures, more customizable filters, reports, etc.” Source

Ideal for: Companies of all sizes seeking an integrated HR and payroll solution, particularly those looking to streamline their payroll processes and improve overall HR efficiency.

Pricing

Undisclosed

By using payroll software, small businesses can avoid the risks and challenges of manual payroll processing. Here’s why small businesses and startups should consider using payroll software:

Regulatory compliance: With constantly evolving labour laws and tax regulations, payroll software ensures businesses stay compliant, avoiding costly penalties and legal issues

Reducing errors: Manual calculations are prone to mistakes, leading to incorrect payments and dissatisfied employees. Automated systems minimise these errors, ensuring accurate and timely salary disbursements.

Time and resource optimisation: By automating repetitive tasks, payroll software frees up HR and finance teams to focus on strategic initiatives, driving business growth

Scalability: As businesses expand, payroll complexity increases. Payroll software easily adapts to growing employee numbers and changing organisational structures without significant manual adjustments

Risk management: Standardised payroll operations reduce dependency on individual personnel, ensuring business continuity during employee turnover or absences

Employee trust and transparency: Accurate, on-time payments and easy access to pay information through self-service portals enhance employee satisfaction and trust in the organisation

Data security: Advanced encryption and access controls protect sensitive payroll information, mitigating the risk of data breaches

Strategic decision-making: Comprehensive reporting and analytics provide valuable insights for data-driven workforce planning and budgeting

Automation: Eliminates manual calculations and spreadsheet work for salary processing

Accuracy: Reduces errors in tax deductions and salary components

Time-saving: Speeds up payroll processing with one-click salary transfers

Compliance: Automatically handles tax regulations like TDS, PF, and ESI

Employee self-service: Provides a portal for employees to access payslips and tax documents

Integration: Syncs with attendance and leave management for accurate salary calculation

Scalability: Adapts to growing businesses and handles various employee types

Reporting: Generates detailed payroll reports and analytics for informed decisions

Customisation: Allows for flexible salary structures and components as per company needs

Cost-efficiency: Reduces expenses associated with manual payroll management

By now, you know what features to look for in the best payroll software, the top payroll systems in India, and their pricing and use cases. It's time to make a decision.

If you plan to try out these tools individually, start with Craze.

Sounds biased? Maybe, but hear us out. You are a perfect fit for Craze if:

You are searching for a people operating system that handles finance, HR and IT all in one single dashboard

You are frustrated with the existing payroll software in India as most of these tools restrict all the advanced features for the premium plans

You want to work with an empathetic team that understands your struggles and is genuinely interested in helping you

Sounds like a fit? It's time to meet the Craze team.

What is Payroll Software?

Payroll software automates salary calculations, tax deductions, and business compliance tasks. It streamlines payroll processing, generates payslips, and often includes employee self-service portals for accessing pay information.

What is the best payroll software in India?

Craze stands out as the best payroll software in India, especially for startups and small businesses. It offers flexible pricing, comprehensive features, and user-friendly interfaces. While other options exist, Craze provides the ideal balance of affordability and functionality for growing companies.

What is the cost of payroll software in India?

The cost of payroll software in India ranges from ₹40 to ₹150 per employee per month, depending on the features and the number of employees.

What are the different steps in Payroll Processing?

Payroll processing involves collecting employee data, calculating salaries, applying deductions, ensuring compliance, generating payslips, disbursing salaries, and creating reports. Many software solutions automate these steps for efficiency and accuracy.

What challenges are there with payroll software?

Common challenges include integrating with existing systems, maintaining confidentiality of user data, complying with location-specific regulations, and customising for specific business needs. User adoption and proper training can also be challenging for some organisations.

Does payroll software handle accurate payroll processing?

The best payroll management software automates payroll processing, freeing HR professionals from manual processes.

Does payroll software offer leave management and core HR as built-in features?

Yes, payroll software like Craze has a strong core HR and built-in leave management software that syncs deeply in real-time.