Demystifying CTC

October 9, 2024

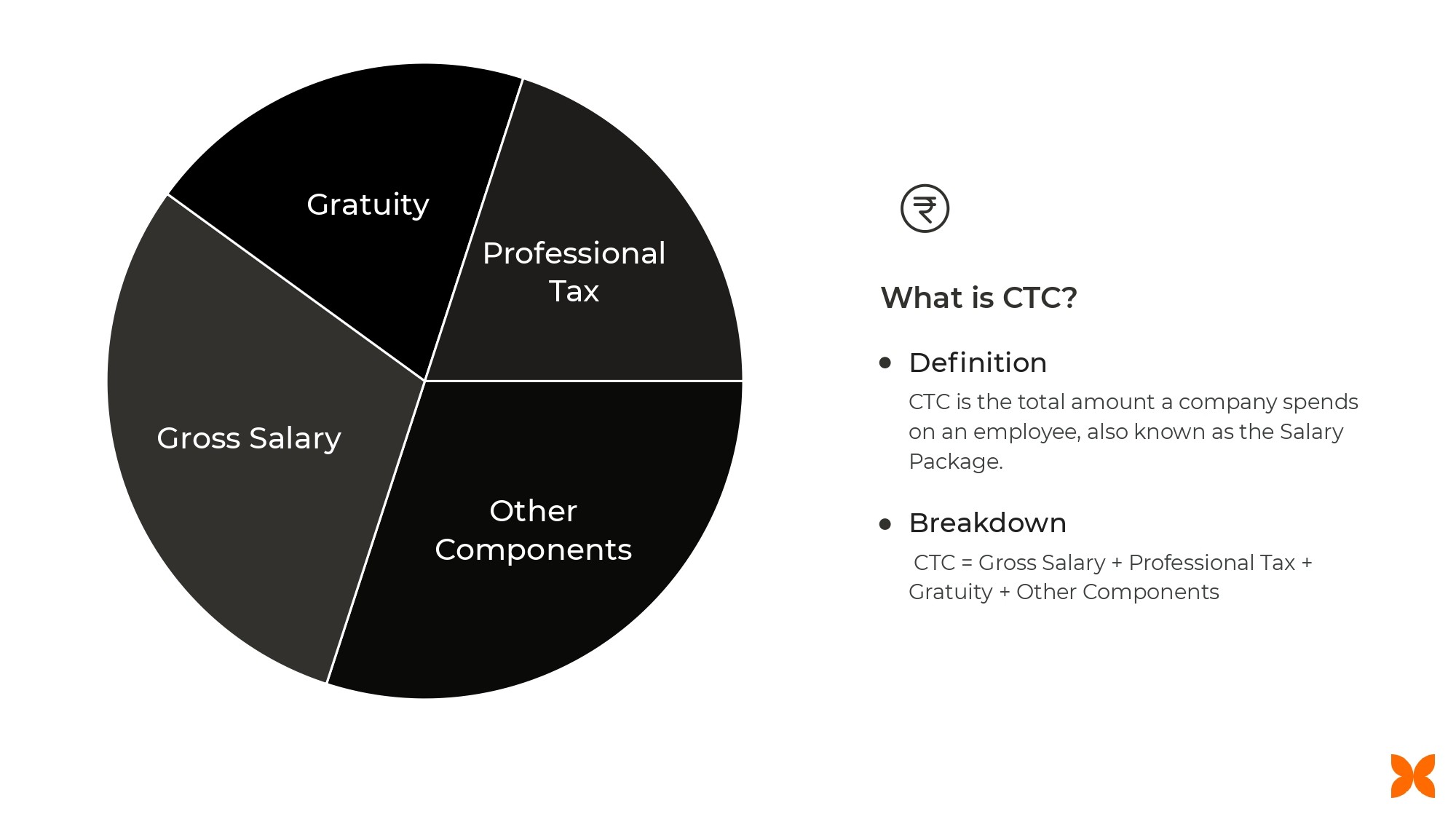

Introduction to Cost to Company (CTC)

Cost to Company (CTC) is a term that often appears in job offers, but not everyone fully understands what it means. At its core, CTC represents the total amount a company spends on an employee in a year. This encompasses more than just the take-home salary; it includes various benefits, taxes, and other compensation components that together form the complete cost for the employer.

Why is understanding CTC important?

For employers, CTC allows them to get a comprehensive view of their expenses for each employee, helping in budgeting and assessing workforce costs. It’s a strategic metric that enables companies to manage their human resources expenses effectively.

For employees, CTC provides insight into the full value of their compensation package, though it can be misleading at times. Many employees mistakenly equate CTC with take-home pay, when in fact, CTC is the gross compensation and includes deductions such as taxes, provident fund contributions, and other components that do not directly translate to in-hand salary.

Common Misconceptions About CTC

CTC equals Take-Home Pay- This is the most widespread misconception. CTC includes many components like provident fund, gratuity, and performance bonuses, which are not directly paid out as part of monthly salary.

Higher CTC means better pay- While a higher CTC may look impressive, it doesn’t necessarily mean a higher take-home salary. Deductions for taxes, provident fund, and other allowances can reduce the net salary significantly.

Bonuses and Reimbursements are fully included in salary- Often, parts of the CTC include performance bonuses, insurance, or reimbursements, which depend on certain conditions and may not be part of the immediate salary.

Breakdown of CTC Components

Gross Salary

Gross salary is the total amount an employee earns before any deductions. This is a key component of CTC and includes various allowances that can affect the final in-hand salary. Gross salary typically comprises:

Basic Salary: This forms the core of the gross salary, often set as a percentage (e.g., 50%) of the total gross. It is used to calculate other allowances and statutory deductions such as provident fund (PF).

House Rent Allowance (HRA): This allowance helps employees cover housing expenses and is calculated as a percentage of the basic salary (typically around 15% to 20%).

Other Allowances: These can include special allowances (e.g., for travel or work-from-home expenses) and other direct benefits. These allowances vary across companies and roles but are added to make up the gross salary.

Net Salary

Net salary, often referred to as "in-hand" or "take-home" pay, is the amount that an employee receives after deductions from the gross salary. These deductions usually include:

Income Tax: Based on the tax slab applicable to the employee’s earnings.

Provident Fund (PF): A portion of the basic salary contributed toward retirement savings, deducted from the employee’s pay, and matched by the employer.

Employee State Insurance (ESIC): Contributions toward social security, applicable for employees earning below a certain threshold.

Professional Tax: A state-imposed tax applicable in some regions.

Net Salary = Gross Salary – Income Tax – Profession Tax – Provident Fund – ESIC.

Other Components

CTC often includes benefits and bonuses that do not directly contribute to the monthly take-home pay but form an important part of the overall package. Some of these components include:

Gratuity: A post-employment benefit payable to employees after a specified period of service (typically five years). Although part of the CTC, this is not available monthly.

Bonuses: Companies may include performance-based or annual bonuses in the CTC calculation. These are conditional and may be paid out based on specific criteria.

Reimbursements: Reimbursements for expenses incurred by the employee on behalf of the company (e.g., travel, mobile bills) are typically not taxable and are not considered part of the CTC.

The Difference Between Gross Salary and Net Salary

The journey from gross salary to net salary involves several deductions that can significantly reduce the in-hand amount. Gross salary refers to the total amount earned by the employee before any deductions, and net salary (or take-home pay) is the final amount that an employee receives after these deductions. Common deductions include:

Income Tax: A mandatory deduction based on the employee's tax bracket. The amount varies depending on the applicable tax slab and whether the employee is claiming any tax exemptions or deductions.

Provident Fund (PF): A statutory deduction where both the employee and employer contribute a portion of the basic salary towards retirement savings.

Employee State Insurance (ESIC): A deduction applicable for employees earning below a certain threshold. It provides medical, maternity, and disability benefits.

Professional Tax: A state-imposed tax deducted from an employee’s salary in certain regions of India.

Each of these deductions serves a specific purpose, ranging from social security contributions to tax liabilities.

Taxable Salary vs. Exempt Components

While most of the gross salary is taxable, certain components are exempt under the Income Tax Act, helping employees reduce their tax burden. Taxable salary is calculated as:

Taxable Salary = Gross Salary – Tax Exempt Allowances – Tax Saving Deductions

Exempt Allowances: Certain allowances provided by the employer may be exempt from tax, such as house rent allowance (HRA), leave travel allowance (LTA), and food coupons. These allowances reduce the taxable income.

Reimbursements: Expenses incurred by employees on behalf of the company, such as travel expenses, are reimbursed by the employer. These reimbursements are not taxable and do not form part of the gross or taxable salary.

A Flow from Gross to Net Salary

To understand the flow from gross to net salary, let’s break it down step-by-step using a simple example:

Gross Salary: ₹100,000 per month (basic + HRA + other allowances).

Deductions:

Provident Fund: ₹1,800

Income Tax: ₹5,959

Professional Tax: ₹200

ESIC (if applicable): ₹200

Net Salary Calculation:

Net Salary = Gross Salary – (PF + Income Tax + Professional Tax + ESIC)

Net Salary = ₹100,000 – (₹1,800 + ₹5,959 + ₹200 + ₹200)

Net Salary = ₹92,041 per month.

This final amount is what the employee receives in their bank account after all statutory and social security deductions are made.

Taxable Salary and Deductions

How Taxable Salary is Calculated

Taxable salary is the portion of an employee’s gross salary on which income tax is payable. It’s derived by deducting tax-exempt components and tax-saving deductions from the gross salary. The formula for calculating taxable salary is:

Taxable Salary = Gross Salary – Tax Exempt Allowances – Tax Saving Deductions

Here’s a breakdown of the key elements:

Gross Salary: The total earnings before any deductions.

Tax Exempt Allowances: Certain allowances such as house rent allowance (HRA), leave travel allowance (LTA), or medical reimbursements are not fully taxable.

Tax Saving Deductions: Deductions under the Income Tax Act, primarily Section 80C, allow employees to reduce their taxable salary. Contributions to provident fund, life insurance premiums, and certain investments qualify for these deductions.

Once these allowances and deductions are subtracted from the gross salary, the remaining portion is considered taxable.

Importance of Tax-Saving Options

Tax-saving options play a crucial role in reducing taxable income, thus lowering the overall tax liability for an employee. Common tax-saving instruments under Section 80C include:

Employee Provident Fund (EPF): Contributions towards EPF are tax-deductible up to ₹1.5 lakh annually.

Life Insurance Premiums: Payments toward life insurance policies are eligible for deductions.

National Savings Certificates (NSC) and Public Provident Fund (PPF): Investments in these are also deductible under Section 80C.

Health Insurance Premiums: Under Section 80D, health insurance premiums for self and family can also reduce taxable income.

These deductions help employees minimize the income tax they owe by legally reducing their taxable salary.

Examples of Common Salary Deductions and Exemptions

Let’s consider some examples of common deductions and exemptions:

House Rent Allowance (HRA): An employee can claim an exemption on HRA if they live in a rented house. The exemption depends on factors such as basic salary and rent paid.

Leave Travel Allowance (LTA): This is another exemption where an employee can claim travel expenses incurred during leaves, subject to certain conditions.

Medical Reimbursements: Any medical expenses reimbursed by the employer up to a specified limit (e.g., ₹15,000 per year) are tax-exempt.

By leveraging these exemptions and deductions, employees can significantly lower their taxable income.

Related Articles

Real-World Salary Breakdown Examples

To illustrate how various components of the CTC affect in-hand salary, let’s look at salary breakdowns for different income brackets.

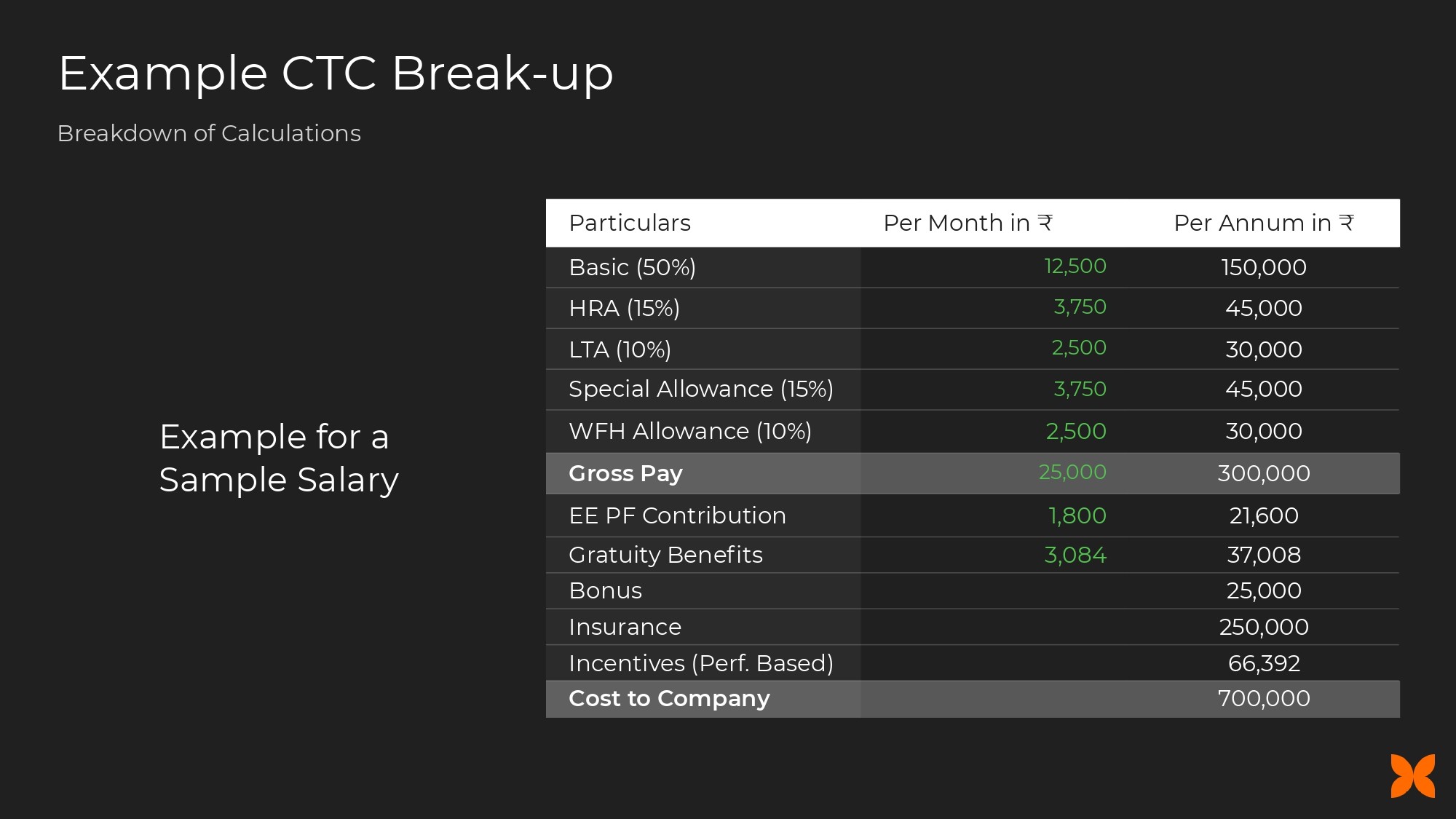

Example 1: Lower Salary Bracket

CTC: ₹7,00,000 per annum

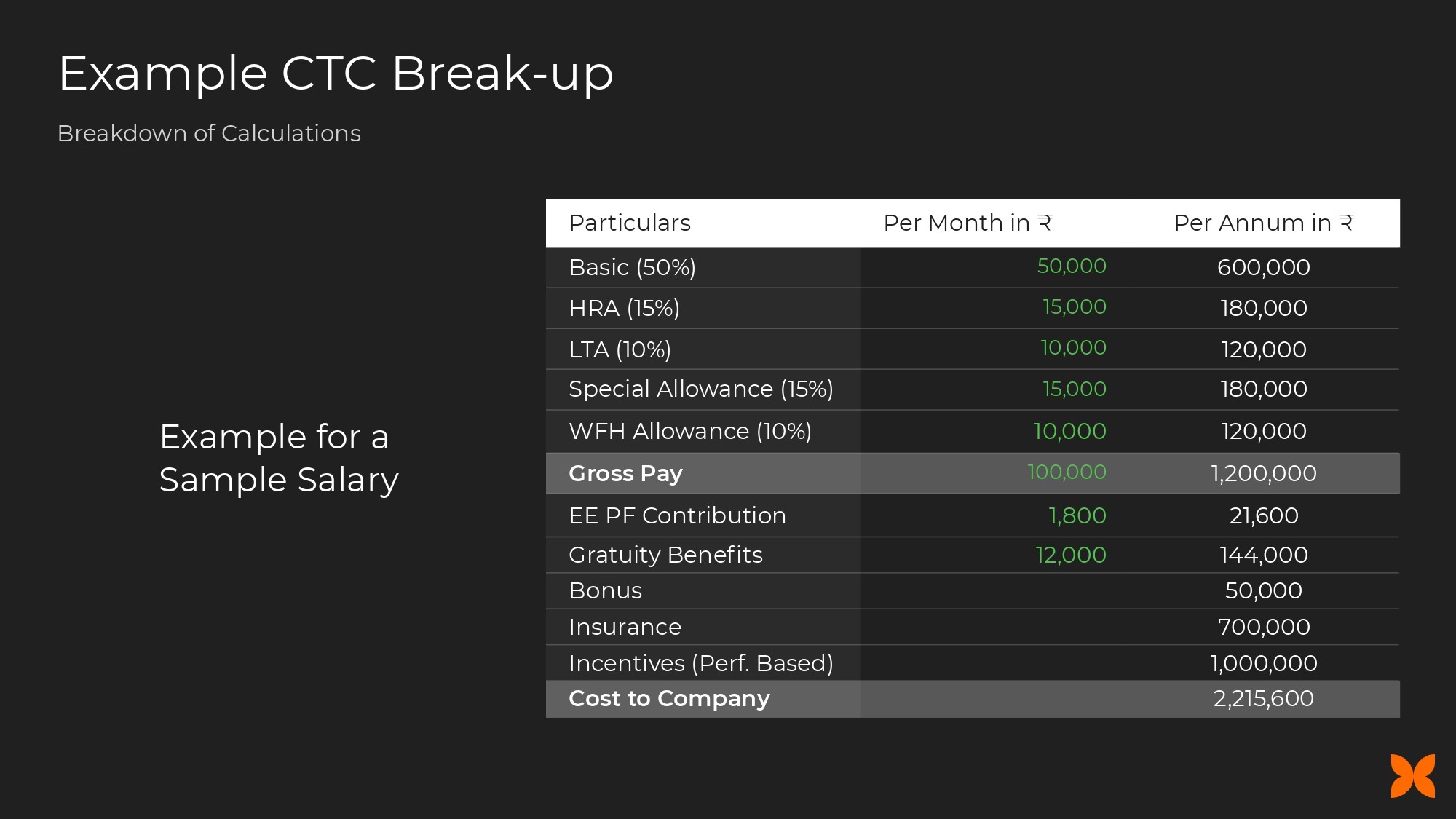

Example 2: Higher Salary Bracket

CTC: ₹22,00,000 per annum

Why Companies Calculate CTC

Companies use Cost to Company (CTC) as a comprehensive metric to understand the total cost incurred for employing an individual. It provides employers with a clear picture of their financial commitment beyond just the salary they pay monthly. The calculation of CTC includes elements like gross salary, bonuses, provident fund contributions, gratuity, and even health insurance, which together represent the total expenditure on an employee in a given year

Purpose of CTC in Workforce Management:

Budgeting and Financial Planning: CTC helps companies plan their finances, especially when calculating the overall cost for their workforce. It allows for better control of employee-related expenses, including taxes, social security contributions, and performance-based bonuses.

Comparison and Evaluation: Employers can use CTC to compare employee costs across different roles, locations, and departments, which is crucial for assessing productivity. Understanding the total cost per employee allows companies to evaluate the return on investment (ROI) each employee brings, especially when calculating productivity and operational efficiency.

Reimbursements- What’s Included?

What Reimbursements Are and Why They Are Not Part of CTC

Reimbursements refer to expenses incurred by an employee on behalf of the company, which are then repaid. These do not form part of the CTC because they are not direct compensation for services but rather refunds for expenses made while performing job-related tasks.

Examples of common reimbursements include:

Travel Expenses: Money spent on business trips or client meetings.

Mobile or Internet Bills: For remote or on-site employees requiring these services to perform their duties.

Food and Accommodation: If employees need to travel or stay overnight for work, these costs can be reimbursed.

Reimbursements are typically not taxable because they are not considered income. Since they are refunded costs, they do not contribute to an employee's take-home salary or total earnings and are not included in the CTC package.

Types of Reimbursements and Employee Benefits

The types of reimbursements can vary depending on the company's policies and the nature of the work performed. Key types include:

Medical Reimbursements: Employers may cover medical expenses up to a certain limit as part of employee benefits.

Conveyance Reimbursements: Costs for commuting or transportation for business purposes.

Food and Accommodation Reimbursements: Particularly for employees required to travel for business.

Conclusion

Understanding Cost to Company (CTC) is crucial for both employees and employers. CTC represents the total compensation, including gross salary, deductions, bonuses, and non-cash benefits, which affect take-home pay. Employers use it to manage workforce costs and productivity.

Mastering CTC enables smarter career and financial planning, ensuring better alignment with personal goals.

FAQs

Why does the take-home pay differ significantly from CTC?

The take-home pay, also known as net salary, is significantly lower than CTC because the CTC includes many components that do not directly reflect in your monthly paycheck. Some of the reasons for this discrepancy are:

Deductions: Income tax, provident fund (PF), Employee State Insurance (ESI), and professional tax are deducted from the gross salary before arriving at the net salary.

Non-Cash Components: Benefits such as gratuity, insurance premiums, and bonuses are part of CTC but are either paid annually, subject to conditions, or deferred (such as gratuity, which is only paid after 5 years of service).

Employer Contributions: Employer contributions to PF and insurance are part of the CTC but do not form part of the in-hand salary.

What are some best practices for negotiating CTC?

When negotiating CTC, it’s crucial to understand the breakdown and focus on the components that affect your monthly net salary. Some tips include:

Ask for the Gross and Net Salary: Request a detailed breakdown of gross and net salary to clearly understand what will hit your bank account each month.

Focus on Take-Home Pay: While CTC might seem attractive, what matters is your in-hand salary. Prioritize understanding the deductions and ensure you negotiate based on what you'll receive after tax and other statutory deductions.

Consider the Benefits: Ask about health insurance, gratuity, bonuses, and reimbursements. Ensure these benefits align with your personal needs and financial planning.